There has been much debate recently regarding the need for a “systemic risk regulator” empowered with the ability to take corrective action to prevent the types of dangerous episodes that have become the norm over the past year. Read this article for a suggestion from Sen. Mark Warner for a systemic risk council.

Derivatives: Implications for Investors

Carol Loomis has written a “must read” article on derivatives which appears in the July 6 issue of Fortune Magazine as well as online at Fortune.com. At a time when regulation of derivatives is a major focus in Washington, it is useful to step back and take a deeper look at the events of the past several years to understand the depth of the problem and the complexities awaiting those who would try to reduce the overall level of systemic risk inherent in these complex instruments. This article provides a few excepts and comments from the article along with my views on how investors can manage risks associated with derivatives.

Buffett Interview: No Green Shoots Yet

In a CNBC interview today, Berkshire Hathaway Chairman and CEO Warren Buffett stated that the economy is not “moving yet” and that “green shoots” were not yet visible. Mr. Buffett joked that he was hoping the cataract operation on his left eye last month would help him see “green shoots” but he has not seen many hopeful indicators of economic growth. Read this article for more details.

Ford CEO Mulally Comments on Federal Loans for Fuel Efficient Cars

The Department of Energy announced that Ford would received $5.5 billion in loans meant to modify factories to make more fuel efficient vehicles. In my opinion, most government driven attempts at industrial policy are destined to fail, but in the context of the immense government bailouts for General Motors and Chrysler, I suppose that a mere $5.5 billion is a mere rounding error. Let’s take a look at Mr. Mulally’s comments today on CNBC.

Rev. Cecil Williams Interviewed on Buffett’s Charity Lunch Auction

In this Fox Business News interview, Rev. Cecil Williams of The Glide Foundation discusses the history behind Warren Buffett’s annual charity auction on EBay. Each year, Mr. Buffett sets up an auction where he agrees to have lunch with the winning bidder and seven others. It took $2.1 million to win the auction in 2008 and I suspect a similar figure is likely this year as well.

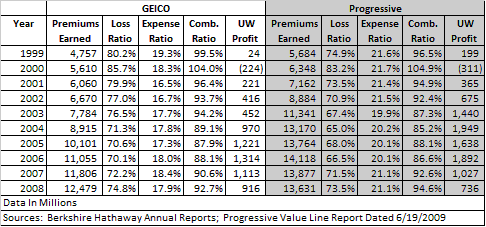

GEICO vs. Progressive: Selected Ten Year Metrics

Today, I reviewed Value Line’s latest coverage of the Property/Casualty Insurance Industry. I spent a bit more time on Progressive than on most of the other company profiles. I have not followed Progressive in great detail in the past other than being aware of it in the context of reading about GEICO which is a Berkshire Hathaway subsidiary. I have covered GEICO in some detail on this site in the context of Berkshire’s overall results. Read this article for a brief comparison of the ten year records of Progressive and GEICO.

Berkshire Hathaway Options Revisited

I wrote about the introduction of Berkshire Hathaway options on the CBOE on Wednesday. Now that more details are available and trading has begun, it is interesting to take a brief look at how these option contracts may be utilized by the speculator or investor. Read this article for more details.

US Bancorp CEO on TARP Repayment

CNBC interviewed US Bancorp CEO Richard Davis regarding his bank’s repayment of TARP funds. In addition, Mr. Davis talks about retiring the ten year warrants that were issued as part of the TARP arrangement and projects that US Bancorp will not need to issue additional FDIC insured debt.

Berkshire Hathaway Options Trading May Facilitate Speculative Behavior

Bloomberg has reported that the Chicago Board Options Exchange (CBOE) will begin offering options contracts on Berkshire Hathaway Class B shares starting tomorrow. While options can occasionally be useful for hedging risks or engaging in arbitrage opportunities, they are also often used for speculative purposes that Warren Buffett would probably not approve of.

Alan Mulally Comments on Ford’s Strategy

In late May, I posted an interview with Ford Motor Company’s Chairman Bill Ford regarding the company’s plans for battery technology. CNBC interviewed Ford’s CEO Alan Mulally today. Topics covered include Ford’s product lineup, plans for hybrid vehicles, the impact of the GM and Chrysler bankruptcies, the health of auto suppliers (recently turned away in their requests for additional Federal bailout funds), the “cash for clunkers” plan, and more.

Goldman Sachs Favors Discretionary Retailers in Wal-Mart Downgrade

In what appears to be a downgrade based mostly on a macro call for economic recovery, Goldman Sachs downgraded Wal-Mart stores today from “buy” to “neutral” and lowered the price target on the stock to $56 from $58. While I have not been able to locate the full text of Goldman’s report online, the Wall Street Journal published a couple of excerpts which I have referenced in this article.

Iscar Chairman Eitan Wertheimer Interview

In this Fox Business News video, Iscar Chairman Eitan Wertheimer comments on the impact of the global recession on his company. Mr. Wertheimer discusses how lower automobile production will impact Iscar as well as his ability to avoid layoffs up to this point. The video also provides important insights into the qualities that Warren Buffett looks for in his managers. The acquisition of Iscar in 2006 was Berkshire Hathaway’s first purchase of a company based outside the United States. View this article for a video interview.

Clayton Homes i-house Videos

Clayton Homes, a Berkshire Hathaway subsidiary, has been the subject of several articles on this site over the past few months. Clayton Homes maintained a very admirable track record related to mortgage financing throughout the housing bubble and, as a result, the company has experienced fewer mortgage delinquencies and foreclosures. Clayton recently unveiled a payment protection plan intended to protect buyers against a temporary loss of employment for a limited period. Read this article for more details and two videos showing the i-house.

James Grant Comments on Fed Policy and Interest Rate Outlook

James Grant, publisher of Grant’s Interest Rate Observer, appeared on CNBC today and commented on Federal Reserve policy and his outlook for interest rates and inflation. I found the following quote to be particularly interesting. Interested readers should view the video below or, for those reading this via the RSS Feed, click on this link to view the video on CNBC’s site.

MidAmerican’s David Sokol: Cap and Trade to Add $120/month to Electric Bills

MidAmerican’s Chairman David Sokol was interviewed by Bloomberg today in Washington. Mr. Sokol has been advocating for the elimination of the concept of trading carbon credits which is a central feature of the “cap and trade” system that is currently being debated in Congress. Read this article for more details and to view the video.

Coca Cola CEO Muhtar Kent on Moody’s Upgrade and Future Prospects

Muhtar Kent was named CEO of Coca Cola in 2008 and was recently named Chairman of the Board of Directors. I have not had an opportunity to listen to Mr. Kent speak about the company in the past and found his comments on Coca Cola’s future prospects and general economic conditions quite interesting. Read this article for more information and a video of Mr. Kent.

SIFMA Municipal Bond Summit: Lessons and Outlook for Recovery

The Securities Industry and Financial Markets Association (SIFMA) held a conference on June 8 to address a number of important issues facing the municipal bond industry. SIFMA’s President and CEO Timothy Ryan made opening remarks regarding the challenges facing municipal bond issuers and was followed by a number of other speakers. Read this article for more details.

Medtronic CEO Bill Hawkins Interviewed on Diabetes Control Devices

I have been researching various companies in the field of medical supplies and devices in recent days given that many companies in the sector have yet to fully participate in the recent stock market rally and trade at lower valuations than they have historically. One of the companies I have been reading about is Medtronic, Inc. which is engaged in the development of various types of implantable medical devices. I happened to find the video appearing below in which CNBC interviews CEO Bill Hawkins at the American Diabetes Association annual meeting in New Orleans which is taking place this week. Read this article for more details and for the video.