Over the past decade, investors have learned that there is a significant difference between identifying a great business and making a great investment. A quick look at the charts of dozens of leading companies demonstrates the fact that a business can continue to progress nicely in terms of delivering earnings and cash flows to shareholders while the company’s stock price can stagnate or decline. We have pointed out some prominent examples of this disappointing situation, most recently in coverage of Microsoft, Johnson & Johnson, and Wal-Mart. In most cases, optimistic assumptions led investors to pay far too much for these companies and a decade of stagnation has been the consequence. Most mistakes were driven by overly optimistic assumptions by analysts which led to wildly incorrect price targets.

In this article, we will take a brief look at the “consensus” view regarding Intel Corporation with a focus on Value Line’s latest report on the company. Our purpose is not to make a complete investment judgment on Intel, but to use apparent consensus expectations as an example of where investors may be led astray by relying on presumed experts without doing their own work. In the case of Value Line’s latest report on Intel, we have an example of an extremely rosy forecast unsupported by much evidence.

Consensus Estimates

According to the First Call Earnings Valuation Report for Intel dated January 20, 2011, the consensus estimates for Intel for the next three years are as follows:

Value Line, which makes all Dow 30 stock reports available free of charge, estimates that Intel will earn $2.00 in 2011 rising to $2.50 by 2013-2015. Value Line is somewhat below the mean estimate for Intel for 2011 but slightly more bullish than average for the 2013-2015 time frame. For our purposes in this article, we will look at Value Line’s assumptions as a rough proxy for the “consensus” and judge whether the logic makes sense.

Value Line publishes both short and long term predictions for stock prices. Since the short term “timeliness” indicator is primarily a momentum based measure for short term speculators, it is not of concern in an article on investing. However, we can look at Value Line’s long term price projection for 2013-2015 which is stated as a range from $45 to $55. Such an outcome would result in a very attractive annualized return for investors who purchase Intel shares today.

Behind the Estimate

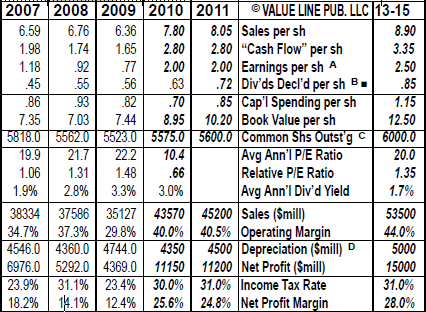

To see how Value Line arrived at the forecast for Intel’s earnings and stock price range for 2013-2015, we must carefully examine the report for the variables involved in the valuation. The image below is a portion of the full report which contains the key data required for Value Line’s price forecast:

The full Value Line report contains data from 1994 to 2010, but we have included only the past four years in the exhibit. Here are the elements of Value Line’s forecast driving the price target in 2013-2015:

- Value Line estimates that Intel will increase sales volume from an estimated $43.57 billion in 2010 to $53.5 billion in the 2013-2015 time frame.

- Net margin is estimated to rise to 28 percent resulting in net profit of $15 billion.

- Shares outstanding are forecast to rise from 5.6 billion to 6.0 billion, resulting in estimated earnings per share of $2.50.

- The P/E ratio is estimated to rise from slightly over 10 today to 20 by 2013-15. Applying a 20 P/E multiple to estimated earnings results in a target price of $50 — the mid-point of Value Line’s $45-$55 price target for 2013-2015.

This sounds wonderful. However, the question is how likely these assumptions will match reality over the next three to five years.

Bullish Assumptions, Little Evidence

If we look at the 2000 to 2010 history contained in Value Line’s report, we can see that a 28 percent net profit margin would be the highest profit margin recorded since Intel posted 31.6 percent net margin in 2000. Net margin has fluctuated between 12.9 percent and 25 percent over the past decade. Value Line is essentially predicting that Intel will soon return to levels of profitability as a percentage of sales not seen since the peak of the dot com bubble in 2000.

If we take Value Line’s $53.5 billion sales estimate and apply a more realistic net margin of 20 percent — still well above the pre-recession margins of 2006 to 2008 — we arrive at net income of $10.7 billion rather than $15 billion. If Value Line is correct about the share count rising to 6 billion, this would result in earnings per share of only $1.78 rather than $2.50. (As an aside, Intel today announced a $10 billion stock buyback so Value Line’s projected share count may be on the high side.)

Turning to the P/E ratio assumption, in light of today’s multiple slightly above 10, Value Line is estimating a near doubling of the P/E ratio to 20 within three to five years. While Intel has routinely traded at multiples at or near 20 over the past five years, it is unclear whether it is safe to assume a return to that valuation in light of what appears to be anemic earnings growth prospects even using Value Line’s bullish assumptions. If we assume multiple expansion from 10 to 15 and apply this to a more conservative earnings per share estimate of $1.75, the target price would be $26.25 rather than $50.

In the narrative section of the Value Line report, the analyst recommends Intel as both a long and short term holding citing prospects for growth due to the strengthening global economy, potential acquisitions, and a number of “interesting products” coming on stream in the next year. However, there is no discussion that supports the estimate of 28 percent net margins or a P/E expansion from 10 to 20 over the next three to five years.

Bottom Line: Critically Examine Estimates

The point of this article is not to pick on Value Line or to make a statement regarding Intel’s valuation. Instead, we simply wish to illustrate the trap that many investors fall into when they take earnings estimates at face value without applying critical judgment to the underlying assumptions.

In general, estimates of earnings several years into the future are extremely difficult to make with any level of accuracy. Using optimistic estimates can “compound” errors particularly if two variables such as net margins and P/E are both raised in a manner that balloons the target price. At the very least, investors should subject analysts who make such projections to critical questioning to determine if they can defend the assumptions behind the price target.

For more information on interpreting Value Line reports, please see our article from last year: The Value Investor’s Guide to Value Line Investment Survey.

Disclosure: No position in Intel Corporation.