The following article is an excerpt from The Rational Walk’s upcoming report: Berkshire Hathaway: In Search of the “Buffett Premium” scheduled for release in early March 2011. Click on this link to download a formatted pdf version of this article, with end notes, links, and references.

Buffett Seizes Opportunities During Financial Crisis

“There are worse situations than drowning in cash and sitting, sitting, sitting. I remember when I wasn’t awash in cash —and I don’t want to go back.” — Berkshire Hathaway Vice Chairman Charlie Munger

If an investor following the literary tradition of Rip Van Winkle had fallen asleep at the start of 2008 and rose from his slumber in early 2011, he could be forgiven for looking at the level of the Standard & Poor’s 500 and thinking that not much had changed over the past three years. For more sentient investors, the past three years have been quite a bit less boring. The United States economy has endured the most severe recession since the Great Depression of the 1930s while the major market averages fell by more than half before staging a steep recovery that few anticipated during the depths of the crisis.

Following Rockefeller’s Example

In October 1929, John D. Rockefeller Sr. responded to the stock market crash by buying a million shares of Standard Oil of New Jersey and issuing a press release stating in part: “These are days when many are discouraged. In the ninety years of my life, depressions have come and gone. Prosperity has always returned, and will again. Believing that the fundamental conditions of the country are sound, my son and I have been purchasing sound common stocks for some days.”

Unfortunately, Rockefeller’s timing left something to be desired and his family’s net worth declined significantly during the subsequent recession, but at the time his statement inspired confidence in the economy.

In the fall of 2008, Warren Buffett wrote an op-ed article for The New York Times that had many close parallels with John D. Rockefeller’s statement nearly eighty years earlier. Mr. Buffett’s article, entitled “Buy American. I Am.” acknowledged the serious turmoil facing the economy but indicated that he had confidence in the American economy and was purchasing American stocks for his personal account.

“A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful. And most certainly, fear is now widespread, gripping even seasoned investors. To be sure, investors are right to be wary of highly leveraged entities or businesses in weak competitive positions. But fears regarding the long-term prosperity of the nation’s many sound companies make no sense. These businesses will indeed suffer earnings hiccups, as they always have. But most major companies will be setting new profit records 5, 10 and 20 years from now.”

— Warren Buffett, New York Times op-ed, October 16, 2008.

Mr. Buffett indicated that his personal account, which had been invested entirely in government bonds, would soon be 100 percent in United States equities if prices continued to become more attractive. He clearly stated that there was no way to predict where stocks would be in a month or a year but that prices would recover substantially well before widespread positive sentiment returned. As it turns out, it is a good thing his goal was not to predict the short term direction of the market because he was several months too early in terms of identifying the market bottom which finally arrived in March 2009. However, at the time his statement did have a brief positive impact on market sentiment.

We briefly examine three of Warren Buffett’s major investment moves during the financial crisis both in terms of results delivered for Berkshire and the impact of his statements and actions on market sentiment in general and the perceived stability of the investees in particular. While Mr. Buffett’s comments on purchases in the public equity markets proved to be well founded, the combined power of his prestige and Berkshire’s hefty cash position were most evident in purchases of securities unavailable to ordinary investors.

Goldman Sachs

Although the definitive history of the financial crisis will probably only appear several years from now, it seems safe to consider the events of mid September 2008 to represent the peak of the crisis and the point at which the entire financial system was at the precipice of disaster. Within a span of several days, Fannie Mae and Freddie Mac were placed into conservatorship, Lehman Brothers was left with no choice but to file for bankruptcy, and Merrill Lynch was forced into the arms of Bank of America.

In this highly charged environment, all financial institutions operated under a cloud of suspicion. The most common question at the time was not whether another major institution would fail, but which bank was the next domino in what seemed like an unstoppable chain reaction.

On September 21, 2008, Goldman Sachs announced that it would convert to a Bank Holding Company subject to regulation by the Federal Reserve. Two days later, Berkshire Hathaway announced that it would invest $5 billion in Goldman Sachs. Media reports at the time highlighted the importance of Warren Buffett’s vote of confidence in Goldman Sachs as being equally important to the capital infusion.

On September 21, 2008, Goldman Sachs announced that it would convert to a Bank Holding Company subject to regulation by the Federal Reserve. Two days later, Berkshire Hathaway announced that it would invest $5 billion in Goldman Sachs. Media reports at the time highlighted the importance of Warren Buffett’s vote of confidence in Goldman Sachs as being equally important to the capital infusion.

On October 1, 2008, Berkshire purchased $5 billion of perpetual preferred shares in Goldman paying a 10 percent annual dividend and also received warrants to buy $5 billion in common stock at a strike price of $115 per share. Goldman has the right to repurchase the preferred shares at any time for a 10 percent premium although approval to execute the buyback is subject to permission from the Federal Reserve. The warrants expire on October 1, 2013. Warren Buffett insisted that Goldman’s top executives agree to limit their personal sales of Goldman common stock until the preferred shares are redeemed or three years had passed from the date of Berkshire’s investment.

At the time that Berkshire’s investment was announced, Goldman also announced an intention to issue $2.5 billion of common stock to the public. On September 29, 2008, Goldman was able to complete a public offering of 46.75 million shares at $123 per share for proceeds of $5.75 billion. On October 28, 2008, Goldman Sachs issued $10 billion of preferred stock to the United States Treasury which paid a 5 percent annual dividend and came with warrants exercisable for ten years at a strike price of $122.90 per share. The overall terms of the government’s investment were clearly not as favorable as Berkshire’s investment.

Berkshire’s investment in Goldman Sachs was executed at favorable terms precisely because Warren Buffett’s “seal of approval” helped to establish confidence that convinced the financial markets that Goldman would be among the survivors of the financial crisis. This confidence shored up Goldman’s stock price in the days following the announcement facilitating the $5.75 billion equity issuance to the public. It is highly doubtful that Goldman Sachs would have been able to raise capital through an issue of common stock at $123 per share without Warren Buffett’s vote of confidence. Debate continues regarding whether Goldman Sachs was truly at risk of failing in September 2008, but few would disagree with the observation that Warren Buffett’s involvement was critical to dissipating a cloud of suspicion that plagued Goldman during those turbulent weeks.

During the fourth quarter of 2008, financial turbulence continued and the price of Goldman’s common stock fell to under $48 intraday on November 21, 2008. While the benefit of hindsight might suggest that Mr. Buffett could have extracted more favorable terms by waiting several more weeks prior to investing, this ignores the stabilizing impact of Berkshire’s investment during the darkest days of the crisis in September and October 2008 and presumes that history would have been unaltered absent Berkshire’s investment. The reality could have been far worse.

In recent months, many analysts have predicted that Goldman Sachs would soon be permitted to redeem Berkshire’s preferred stock investment and may even pursue a buyback of up to 10 percent of its common stock. The combination of the availability of cheaper capital and a likely desire of Goldman executives to eliminate the personal restrictions on share liquidations imposed by Berkshire may lead to repayment in the first half of 2011. Goldman Sachs will have to pay a 10 percent premium of $500 million as part of the process. Berkshire will retain the warrants to purchase $5 billion of Goldman common stock at the $115 strike price and will likely hold these warrants until expiration in October 2013. The warrants are currently comfortably in the money.

General Electric

Based on the public statements made by General Electric’s management in September 2008, the company had no pressing need for outside capital. After issuing a press release revising 2008 earnings guidance on September 25, GE Chairman and CEO Jeffrey Immelt indicated in a conference call that raising additional equity was not on the table. Mr. Immelt told the analysts on the call that he felt secure regarding the strength of the company, overall liquidity, and the state of the balance sheet.

Based on the public statements made by General Electric’s management in September 2008, the company had no pressing need for outside capital. After issuing a press release revising 2008 earnings guidance on September 25, GE Chairman and CEO Jeffrey Immelt indicated in a conference call that raising additional equity was not on the table. Mr. Immelt told the analysts on the call that he felt secure regarding the strength of the company, overall liquidity, and the state of the balance sheet.

Only a few days later, General Electric announced plans to offer $12 billion of common stock to the public as well as Berkshire Hathaway’s $3 billion investment in newly issued GE perpetual preferred stock carrying a dividend of 10 percent and callable after three years at a 10 percent premium. Berkshire also received warrants to purchase $3 billion of common stock at a strike price of $22.25 per share, exercisable at any time over a five year term. Mr. Buffett again insisted that company executives including Mr. Immelt refrain from selling more than 10 percent of the common stock they held until either the date when the preferred stock is redeemed or three years had passed from the date of Berkshire’s investment. The transaction closed on October 16, 2008.

Notably, the title of GE’s press release referred to Warren Buffett announcing an investment in the company rather than more accurately stating that Berkshire Hathaway was making the investment. Clearly, this announcement was specifically intended to increase confidence in GE and to facilitate the planned $12 billion equity sale to the public which closed on October 7, 2008. The following quote from Mr. Buffett illustrates the vote of confidence in GE’s management:

“GE is the symbol of American business to the world. I have been a friend and admirer of GE and its leaders for decades. They have strong global brands and businesses with which I am quite familiar. I am confident that GE will continue to be successful in the years to come.”

If Mr. Buffett’s vote of confidence in Goldman Sachs served to instill confidence in America’s financial system, the investment in General Electric had a similar effect on GE’s global industrial businesses and also may have helped to alleviate some of the fears surrounding GE Capital.

General Electric’s common stock price fell precipitously over the five months following Berkshire’s investment and eventually traded under $7 for a brief period in early March 2009. GE’s stock remains slightly below the strike price on Berkshire’s warrants but the potential remains for the warrants to generate significant profits for Berkshire since expiration will not occur until October 2013.

Swiss Re

On March 23, 2009, Berkshire Hathaway invested CHF 3 billion in a convertible preferred security issued by Swiss Re. The preferred security was in addition to Berkshire’s January 2008 investment in 3 percent of Swiss Re common stock as well as a quota-share reinsurance agreement in which Berkshire assumed 20 percent of Swiss Re’s property/casualty business over a five year period ending in 2012.

At the time of Berkshire’s investment in the convertible preferred, Swiss Re was in danger of losing its AA rating due to heavy investment portfolio losses suffered during 2008. Berkshire’s capital infusion helped to instill confidence in Swiss Re’s future prospects. At the time, Warren Buffett was quoted as being “delighted” with the deal.

Although the investment carried an interest rate of 12 percent, Swiss Re had the right to defer interest payments and could opt to pay interest using shares rather than cash. The investment provided Berkshire with conversion rights but the conversion price was above Swiss Re’s stock price at the time of the deal and Swiss Re retained the right to redeem the instrument at a premium to prevent future dilution. In early November 2010, Berkshire and Swiss Re agreed to terms for the redemption of the security. On February 17, 2011, Swiss Re confirmed that the final repayment took place in January 2011.

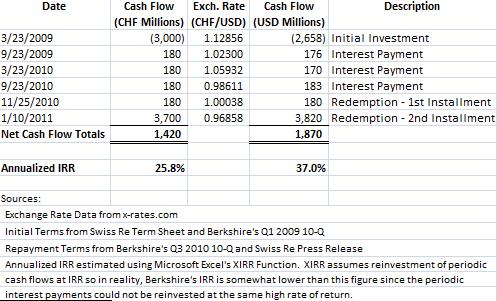

This transaction was far from risk free due to the subordinated status of the instrument compared to Swiss Re’s other debt obligations. However, the deal has produced excellent results for Berkshire. In exchange for a CHF 3 billion initial outlay, Berkshire received an aggregate total of CHF 4.42 billion in interest payments, redemption premium, and repayment of the original principal.

We estimate that the annualized internal rate of return was somewhat under 25.8 percent when expressed in Swiss Francs. However, the Swiss Franc has significantly appreciated over the past two years. Assuming that Berkshire converted interest payments and the redemption proceeds to US Dollars on the date the Swiss Francs were received, we estimate the annualized internal rate of return at somewhat below 37 percent. The exhibit below shows the timing of the cash flows.

Berkshire’s Swiss Re Investment Results

Berkshire’s Swiss Re Investment Results

The original term sheet specified that Swiss Re would have to pay a 40 percent premium if redemption took place prior to the second anniversary of the transaction and 20 percent thereafter. However, Berkshire agreed to accept a 20 percent premium although Swiss Re had to pay interest for Q1 2011 in full.

Other Investments

In addition to the three investments we have discussed, Berkshire Hathaway also made significant investments in Dow Chemical and Wrigley during 2008 and 2009. On April 1, 2009, Berkshire invested $3 billion in Dow Chemical perpetual preferred stock paying dividends of 8.5 percent. Berkshire’s investment helped to facilitate Dow’s acquisition of the Rohm and Hass Company. The preferred stock is convertible into Dow common stock at an effective price of $41.32. On October 6, 2008, Berkshire made an investment in Wrigley comprised of $4.4 billion of 11.45 percent subordinated notes due 2018 and $2.1 billion of Wrigley preferred stock.

While future CEOs of Berkshire Hathaway are very likely to have the cash required to pursue large deals during periods of financial turmoil, it is clear that the terms of Berkshire’s transactions during the 2008-2009 financial crisis were substantially enriched by the intangible benefit of obtaining Warren Buffett’s stamp of approval. Therefore, investors who wish to evaluate whether a “Buffett Premium” exists in the current price of Berkshire Hathaway stock should focus on whether the company’s current valuation assumes that future deals will be available on similar terms. This is a question we will examine in more detail once our valuation of Berkshire is complete.

For more information regarding The Rational Walk’s report on Berkshire Hathaway, scheduled for publication in early March 2011, please click on this link.

Disclosure: Long Berkshire Hathaway.