In late November, many Berkshire Hathaway shareholders were surprised to learn that the company reached an agreement to acquire the Omaha World-Herald in a $200 million transaction. Warren Buffett, Chairman and CEO of Berkshire, has commented on the difficulties facing the newspaper industry on numerous occasions but seemed bullish on the Omaha economy and prospects for the paper to deliver “solid profits” in the future. Berkshire has owned the Buffalo News for over three decades and has a significant minority interest in the Washington Post. As a result, Mr. Buffett clearly knows the industry and feels comfortable enough with the future of newspapers in his hometown to make a long-term ownership commitment.

Although we do not know if Berkshire Hathaway Vice Chairman Charles Munger was involved in the Omaha World-Herald decision, he may have had something to add regarding the prospects for newspapers in general. In addition to his role at Berkshire, Mr. Munger has been Chairman of Daily Journal Corporation since 1977.

Daily Journal (Nasdaq: DJCO) publishes several newspapers in California and Arizona with a specific focus on topics of interest to the legal and real estate professions. Daily Journal, which is unaffiliated with Berkshire Hathaway, has a market capitalization of approximately $90 million. Based on the most recent proxy statement, Mr. Munger owns 9 percent of Daily Journal’s common stock. Over the past few years, Daily Journal’s business has enjoyed exceptionally strong advertising revenues due mainly to increased public notice advertising driven by foreclosure notices. However, dark clouds loom on the horizon as circulation continues to decline and advertising spending appears destined to normalize at much lower levels. In such a situation, a poorly run company would desperately deploy temporarily high cash flows toward ill advised “diversification” schemes while a well run company would responsibly decide to return cash to shareholders and decline gracefully. Mr. Munger appears to have settled on another approach: Daily Journal has effectively transformed into an investment vehicle where a highly concentrated marketable securities portfolio now accounts for the vast majority of the company’s intrinsic value.

Creative Destruction and Newspapers

With few exceptions, the past decade has represented nothing less than a horror show for most general interest newspapers. For many decades in the second half of the twentieth century, owners of local and regional newspapers could count on steady advertising and circulation revenue with growth at least in line with the regional economy. As cities naturally gravitated toward a single newspaper, competition became a thing of the past for many companies and customers were left with few alternatives for news, advertisements, coupons, and important local information.

However, by the late 1990s, the forces of creative destruction began attacking the traditional newspaper business model as readers defected to the internet. The tablet revolution brought about by Apple’s iPad has only accelerated the shift away from traditional papers. Unfortunately, this has represented more than a mere shift in medium as the vast majority of papers have failed to implement a paid circulation model online and must rely on advertisements to justify their internet presence.

These trends can be viewed as a massive deflation in the market value of information as perceived by readers especially when it comes to general interest publications. The normal, acceptable, and expected price point has gravitated steadily toward zero. Specialized publications, particularly related to business and finance, have attempted to implement pay walls with varying degrees of success.

The Wall Street Journal and Financial Times both have been able to implement pay walls due to the specialized financial information they provide. The New York Times recently implemented a pay wall after much delay and deliberation. The fact that the New York Times, one of the country’s most prestigious papers, faced significant resistance does not bode well for local and regional titles.

Daily Journal: A Focus on a Well Defined Niche Market

It is easy enough to obtain free information on a wide variety of general interest topics where publishers have adopted an advertising driven revenue model. However, advertising supported publishing is less viable when the pool of potential readers shrinks as is the case for topics of narrow interest to a specific interest group or profession. Daily Journal’s most important publications are the San Francisco Daily Journal and the Los Angeles Daily Journal (collectively referred to as “The Daily Journals”) which we estimate accounts for well over 95 percent of circulation revenues. While the Daily Journals contain news of general interest, the specific niche market is the legal profession. The subscription cost of $721 per year reflects the specialized information that is delivered. Price increases have averaged 2.3 percent annually since 2001 in contrast to the deflation seen in subscription prices of many general interest newspapers.

Now for the bad news: Paid circulation of The Daily Journals has plummeted in recent years from 16,900 copies in 2001 to 9,200 copies in 2011. Even with the steady price increases, this means that circulation revenue for The Daily Journals is now approximately 68 percent of the revenue achieved a decade ago. The exhibit shows the circulation and revenue run-rate trends of the past decade (Daily Journal’s fiscal year ends September 30):

Daily Journal also publishes nine additional newspapers as well as California Lawyer magazine. Over the past decade, three newspapers have been discontinued (California Real Estate Journal, Antelope Valley Journal and Nevada Journal). In the interest of brevity and because the results of these small papers are immaterial to the company as a whole, we will not present circulation results for the smaller publications. However, it is fair to say that nearly all of the titles have experienced precipitous drops in paid circulation. Surviving titles have at least been able to maintain or modestly increase subscription rates over the past decade.

The Bigger Picture

It is clear that the circulation picture is grim and Daily Journal is facing a long term “secular” decline in readership that does not appear to show any signs of reversal or even stabilization. However, to understand Daily Journal, we need to step back from the circulation woes and take a more comprehensive look at how the company generates revenues, earnings, and cash flow. The following exhibit shows Daily Journal’s revenues for Fiscal 1999 to 2011 by source. As discussed previously, it is apparent that circulation revenues have declined but advertising revenue has expanded in recent years to mitigate the damage. Over the thirteen year period, advertising revenue as a percentage of total revenue increased from 56 percent to 62 percent while circulation revenue as a percentage of total declined from 32 percent to 20 percent.

Daily Journal has operated in two reporting segments since 1999 when the company acquired Sustain Technologies, a small software company that develops case management systems for court systems and other justice agencies. Sustain’s software is certified in twelve states and two countries. Sustain accounts for 9 percent of Daily Journal’s revenues. The “traditional business” segment encompasses the rest of the company’s operations in the publishing industry. The exhibit displayed below provides a summary of the company’s net income by reporting segment.

It is readily apparent that despite Sustain’s minimal importance from a revenue perspective, the segment has caused very erratic results over the past thirteen years. While the large net loss in 2001 reflects a non-cash impairment charge related to capitalized software, Sustain has never been consistently profitable throughout Daily Journal’s ownership. In contrast, the traditional business segment has delivered a more steady performance with results enhanced over the past four years primarily due to public notice advertising revenues and margin expansion.

Free Cash Flow Plowed into Marketable Securities

Daily Journal’s traditional business appears to be in a long term secular decline and Sustain has posted what can only be described as disastrous results. However, Daily Journal has been highly profitable over the past decade with cumulative net income of $50 million from fiscal 2002 to 2011. Free cash flow over the ten year span was also $50 million as depreciation roughly approximated capital expenditures. Other than a small repurchase program and extinguishing a modest amount of debt, management has retained the cash. Until fiscal 2009, the cash was squirreled away in boring treasury bills and notes. However, the strategy changed in 2009 when over $20 million was invested in marketable securities. A further $11 million was invested in marketable securities in fiscal 2011. The exhibit below shows cumulative free cash flow and the principal uses of cash over the past decade.

The reader will likely wonder what “marketable securities” were purchased and how they have performed. The Securities and Exchange Commission apparently had the same question and requested additional details in early 2010 since the information disclosed in the company’s 2009 10-K was quite limited. In response, the company revealed that the investments were made in stocks and bonds of three Fortune 200 companies. Based on changes in unrealized gains of Daily Journal’s portfolio and knowledge of Mr. Munger’s views on certain securities, there has been informed speculation that two of the securities purchased in 2009 were common stock of Wells Fargo and US Bancorp. From the company’s fiscal 2011 10-K, we know that the securities purchased in 2011 were common stock of “two foreign manufacturing companies”. Mr. Munger is an enthusiastic supporter of BYD, the Chinese automaker which, combined with BYD’s declining share price in 2011, would make it a likely investment for Daily Journal.

As of September 30, 2011, Daily Journal held $56.1 million of marketable securities comprised of the $31.6 million invested and $24.5 million of unrealized capital gains. Deferred income taxes related to the unrealized gains were $9.2 million leaving the company with $46.9 million if the securities were liquidated. It would be an understatement to say that Mr. Munger has achieved satisfactory results with these funds.

Daily Journal is Massively Overcapitalized

As a result of retaining the majority of the company’s cash flow over the past decade and making wise investments in marketable securities, Daily Journal is massively overcapitalized today. The company had $65 million of shareholders’ equity as of September 30, 2011 with no debt and $62.5 million of cash, treasury securities and marketable securities, net of deferred income tax. Furthermore, the company has demonstrated that it does not require much tangible equity to operate its business. For example, in 2002, Daily Journal had revenues of $34.3 million and net income of $1.2 million which was supported by average shareholders’ equity of only $4.4 million.

One of the benefits of Daily Journal’s business model is that subscribers pay in advance through annual subscriptions which effectively means that a large portion of Daily Journal’s working capital is funded by subscribers’ advance payments rather than by shareholders’ equity. Demonstrating the same point, Daily Journal had a current ratio of less than 1.0 from 2001 to 2003. One can debate the required level of equity to run the business given today’s economic environment for newspaper publishing but clearly it is nowhere near the equity currently on the balance sheet.

Valuing the Business

In order to arrive at a valuation for Daily Journal, it is necessary to look at the company as having three distinct operations: traditional publishing, Sustain, and the investment operations. We make this assertion with full knowledge of the fact that Daily Journal is on record stating that they have no intention of turning into an investment firm. From the SEC correspondence previously cited, the company stated:

Daily Journal Corporation has two businesses: a publishing business and a software development business. We do not aspire to have an investing business. Cash flows generated from publishing and software development will be invested in our two businesses or used to repurchase our common stock as deemed appropriate by management and the Board of Directors, and we may entertain business acquisition opportunities. Any excess cash flows will be invested in such instruments as the Board deems appropriate at the time. Such instruments may include additional securities of the companies in which we have already invested, securities of other companies, government securities (including U.S. Treasury Notes and Bills) or other instruments. The decision as to particular investments will be driven by the Board of Directors’ belief about the risk/reward profile of the various investment choices at the time, and it may return to government securities as a default if attractive opportunities for a better return are not available. The Board does not at this time contemplate the paying of a dividend, but it reserves the right to do so in the future.

Management also candidly states that excess cash flow driven by publishing foreclosure notices may “become just a memory”. However, despite management’s statement, we find no alternative to viewing the securities portfolio as a distinct source of value since it is unrelated to the operating business and unnecessary to support business operations.

Traditional Business

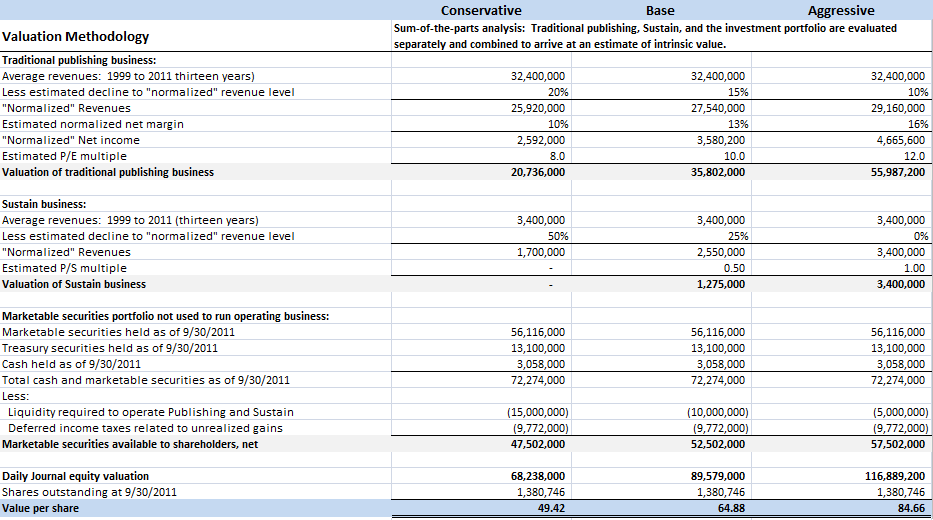

We adopt a conservative posture in valuing the traditional business in light of management’s statements about the future. We start with average revenues for the past thirteen years of $32.4 million and then assume a “haircut” between 10 to 20 percent to arrive at “normalized” revenues. We then apply a normalized net margin assumption between 10 and 16 percent, well below recent net margins exceeding 20 percent. Finally, we apply a P/E multiple of between 8 and 12 to the normalized net income result for each scenario. The result is that we value the traditional business at between $20.7 million and $56 million, admittedly a very wide range.

Sustain

It is unclear whether Sustain’s operations are worth anything given the history of erratic results and large cumulative losses. However, it is possible that Sustain may engineer a turnaround or be acquired by a larger company that spots “synergies” or other benefits from Sustain. We value Sustain by estimating “normalized” revenue as the average revenues for the past thirteen years of $3.4 million and then applying a “haircut” assuming continued decline in the business. We then apply a price-to-sales multiple of between 0 and 1 to arrive at an intrinsic value range of between zero and $3.4 million.

Marketable Securities

We start with taking the sum of marketable securities, treasury securities, and cash held as of September 30, 2011 and then deducting deferred income taxes associated with unrealized gains. From this amount, we also deduct a sum intended to reflect the liquidity needs of the traditional publishing and Sustain business operations. The range of needed liquidity is between $5 million and $15 million and is intended to provide the company with a current ratio of roughly between 1 and 2 depending on the amount selected. In a period of continued declines in circulation revenue, it is possible that the company may require somewhat more working capital than in the past.

The exhibit below provides a summary of the valuation approach using a conservative, baseline, and aggressive set of assumptions.

It should be emphasized that if one assumes results in the traditional business anywhere near recent results, the company looks much cheaper. For example, if we deduct $50 million of excess capital from Daily Journal’s current $90 million valuation, it would appear that one is paying only $40 million for a company that produced nearly $8 million of net income over the past year. Even a declining but profitable business is normally worth in excess of five times earnings. However, rather than anchoring on recent earnings, we believe that it is more prudent to go through the exercise described here where the valuation starts with normalized revenues and margins consistent with the period prior to the foreclosure boom that is responsible for Daily Journal’s recent results. As a result, under the baseline scenario, the company appears fairly valued rather than extremely cheap.

One additional objection is that we are not ascribing any additional value to the investment returns Mr. Munger may generate with the marketable securities portfolio going forward. This is a fair criticism but introducing such a calculation into the mix could be viewed as speculative given the company’s stated intention to not transform into an investing business.

Risks

There are a number of risks that must be assessed in addition to the dangers we have already discussed related to Daily Journal’s publishing business and the prospect of further losses at Sustain.

First, the company’s long serving Chief Executive Gerald Salzman is 71 years old and wears many hats. According to the company’s 10-K, Mr. Salzman serves as president, CEO, CFO, treasurer, assistant secretary, and is also a director of the company:

If Mr. Salzman’s services were no longer available to the Company, it is unlikely that the Company could find a single replacement to perform all of the duties now handled by him, and it could have a significant adverse affect on the Company’s business. The Company does not carry key man life insurance, nor has it entered into an employment agreement with Mr. Salzman.

Mr. Salzman has been with the company since 1986 and is clearly a key executive. Succession planning is unclear other than the statement that multiple executives will have to be recruited in order to replace Mr. Salzman when he eventually retires or is no longer able to work. This could result in operational problems and a higher executive compensation cost structure.

Second, the investment portfolio is currently managed by Mr. Munger who is nearly 88 years old and has an outstanding long term investing track record. Anyone who has attended a Berkshire Hathaway annual meeting knows that Mr. Munger is not an average 88 year old since he is vigorous enough to actively participate in a 5 1/2 hour question and answer session and participate in other meeting activities.

According to the latest 10-K, Mr. Munger consults with the company’s Vice Chairman, J. P. Guerin, on investment matters. Those who have read Warren Buffett’s famous article The Superinvestors of Graham and Doddsville may recall Mr. Guerin as one of the value investors who was profiled. From 1965 to 1983, Mr. Guerin achieved a spectacular return of 22,200 percent vs. 316 percent for the S&P 500. At age 81, however, Mr. Guerin is not much younger than Mr. Munger.

Finally, we have the risk of the marketable securities portfolio itself which is highly concentrated and likely to be heavily allocated to financial companies and a controversial Chinese auto manufacturer. It is by no means assured that the value of the portfolio will not sustain permanent losses under certain situations, although Mr. Munger’s decades of experience mitigate the risk substantially.

Conclusions

The Daily Journal Corporation represents a fascinating case study of a declining business that is still generating significant free cash flow that has been intelligently deployed by management to create additional value for shareholders. Such a company is in a distinct minority since most firms facing decline tend to pursue value destroying acquisitions or capital investments rather than “accept defeat” gracefully and return cash to shareholders. It seems likely that Daily Journal’s publishing operations will continue to decline over time and Sustain is an unpleasant wildcard threatening to destroy additional value. However, with Mr. Munger at the helm, the marketable securities portfolio seems likely to at least preserve value for shareholders. Once Mr. Munger and Mr. Guerin are no longer involved with the company, it would seem only logical to distribute funds to shareholders since there will not be any in-house capability for managing a large investment operation.

To answer the question posed by the title of this article, Daily Journal is not a “rising hedge fund” given management’s intentions to not develop an investment business. However, it is at least a quasi investment fund operated by Mr. Munger that does not carry a typical “2 and 20” fee structure. This may intrigue venturesome investors who are also optimistic (or at least not terribly pessimistic) about the durability of the operating business.

Disclosure: No position in Daily Journal Corporation