Joy Global is a leading manufacturer of underground and surface mining equipment used in the extraction of coal and other minerals. The company manufactures essential and highly specialized products such as continuous miners, longwall shearers, and roof supports critical for safety in modern mines.

Joy Global is a leading manufacturer of underground and surface mining equipment used in the extraction of coal and other minerals. The company manufactures essential and highly specialized products such as continuous miners, longwall shearers, and roof supports critical for safety in modern mines.

Such equipment carries high price tags and requires continuous maintenance and support. In recent years, original equipment has accounted for approximately 40 percent of Joy Global’s sales with the remainder accounted for by aftermarket parts and services. Based on reading this description, Joy Global should be categorized as a cyclical company that can be expected to do well in times of economic strength and face headwinds during recessionary periods. The market certainly agrees: At around $50, Joy Global trades at under eight times trailing earnings.

Alexander Roepers, founder and Chief Investment Officer of Atlantic Investment Management recently described his bullish views on Joy Global in the Spring 2012 issue of Graham & Doddsville (pdf). Graham & Doddsville is a free newsletter published by Columbia Business School students and is well worth reading. Note that Joy Global was trading at a significantly higher price at the time the Graham & Doddsville article was published. Mr. Roepers concluded his bullish thesis as follows:

For the bears, Joy’s shares are pricing in peak earnings per share of $7 or $8, so it’s trading at 10x peak earnings. But, in our view, these are not peak earnings. We see Joy’s earnings trending up over time. They had one flat year in earnings in the Great Recession. Caterpillar earnings were down 60%. Sales were down nearly 40% at Caterpillar, while sales at Joy were flat.

Interestingly, Wall Street’s “consensus” estimates for the current fiscal year still reflect healthy earnings growth. Value Line’s June 8 coverage of the company forecasts earnings of $10.65 by 2015-2017. Putting aside the questionable accuracy of earnings estimates years into the future, we can see that market participants have not explicitly called for a drop in earnings yet, although the stock price seems to foresee a decline. Intrigued by Mr. Roepers thoughts on Joy Global and the subsequent decline in the company’s stock price, we decided to take a look at the fundamentals to determine both the upside potential and downside risk.

Coal: Perception and Reality

To understand Joy Global, it is necessary to step back and look at the high level dynamics driving the coal industry. Coal is probably the most hated fossil fuel in existence because it is dirty compared to alternative forms of energy, particularly natural gas. According to the EPA, natural gas fired power generation “produces half as much carbon dioxide, less than a third as much nitrogen oxides, and one percent as much sulfur oxides” compared to coal.

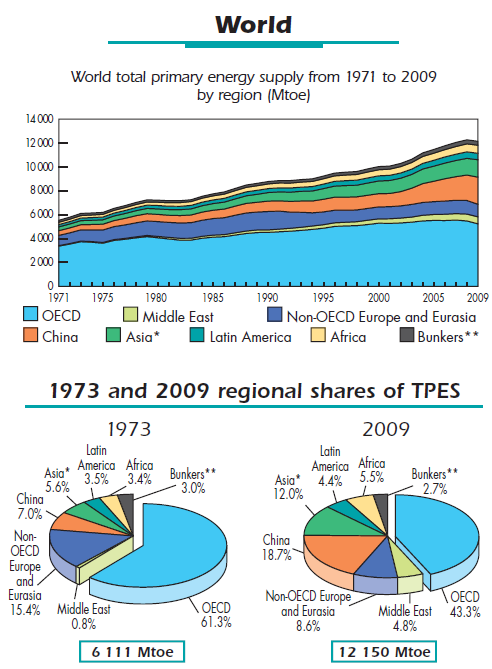

Much to the chagrin of environmentalists, the use of coal has increased significantly over the past few decades both in absolute terms and as a percentage of total primary energy supply according to the International Energy Agency’s 2011 Key World Energy Statistics publication. The following chart taken from the report shows world total primary energy supply from 1971 to 2009 by fuel type:

In 1973, coal and peat accounted for 24.6 percent of the total versus 27.2 percent of the total in 2009. As the reader may guess, this trend has been driven by emerging economies. Use of coal use within the OECD group of richer countries fell from 22.6 percent of the total in 1973 to 20.2 percent in 2009. The majority of the increase in coal use has been in the poorer parts of the world with China being the most notable example. The following charts show the breakdown of worldwide energy use by region/country:

According to the IEA, China is the largest producer of coal in the world at 3,162 million tons of production in 2010. The United States was in second place at 932 million tons with India in third place at 538 million tons. China’s world leading production is not even sufficient to keep up with demand and the country imported an additional 157 million tons in 2010. According to Mr. Roepers, 70 percent of China’s electricity is generated from coal.

What About Cheap Natural Gas?

Cheap and abundant natural gas clearly poses a threat to coal fired electricity generation in the United States. However, as The Economist’s recent survey on natural gas made clear, the supply and demand dynamics that have created low natural gas prices in the United States are not present in most other parts of the world. Natural gas prices in Asia are far higher than in the United States and the cost of liquefying and shipping natural gas is not only expensive but requires extensive infrastructure to support. Clearly coal will not be going away anytime soon as a primary energy source in China. The inexorable rise in energy demand in China could very well slow in an economic recession but the secular trend demonstrates rising demand over time and much of that demand will be fueled by coal for years to come.

Joy Global’s Track Record

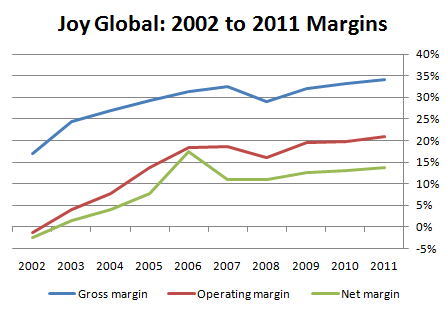

Readers are encouraged to review the business summary section of Joy Global’s fiscal 2011 10-K for general background information on the company and its long history. The company went through a bankruptcy reorganization and emerged from the process in July 2001. Since that time, the company has posted strong results with revenues rising from $1.15 billion in fiscal 2002 to $4.4 billion in fiscal 2011 (year ended October 28, 2011). Net income rose from a loss of $28 million in fiscal 2002 to a profit of $610 million in fiscal 2011. The following exhibit shows the steady margin expansion driving these results:

The company has delivered attractive returns on equity and total capital over the past decade. As of April 27, 2012, total debt was 41 percent of capital:

Consistently high returns on capital often indicates the presence of an economic moat. In the case of Joy Global, this may come from the fact that the mining equipment industry is essentially a duopoly with large barriers to entry according to Mr. Roepers:

Joy Global has a strong competitive position with enormous barriers to entry. Two Milwaukee based companies, the other being Caterpillar subsidiary Bucyrus International, control the market – it’s a duopoly. No one else in the world can make these pieces of equipment. At Joy’s factory, in order to support the stamping equipment used to construct the equipment, JOY has a 200 feet deep concrete foundation beneath their machines. Regulators will not provide approval today for a plant requiring 200 feet of concrete.

During the 2008-2010 economic downturn, Joy Global’s results barely missed a beat with only a modest decline in revenue from fiscal 2009 to fiscal 2010. Margins were maintaining along with profitability. Despite having many characteristics of a cyclical company, Joy Global did not post steep revenue declines and ruinous losses when the world economy misfired.

Aftermarket Parts – Stabilizing Factor

There are probably many contributing factors to Joy Global’s robust record even during times of economic slowdown. One factor is likely to be the company’s revenue mix by product type. The company’s original equipment products are clearly high dollar purchases for customers and the timing is likely to be somewhat discretionary in nature. If a mining company is breaking ground on a new mine, it is likely to require new equipment but aging equipment in existing mines can often be coaxed into additional years of service during tough economic times.

Joy Global maintains an extensive network of service and distribution centers capable of rebuilding and servicing equipment and selling replacement parts and other consumable items. As the installed base of equipment grows, so does the opportunity to service the equipment over time. Such equipment is very expensive and specialized and customers are probably reluctant to choose a “bargain” priced company to service the equipment. As a result, Joy Global enjoys a “moat” when it comes to servicing its installed base. The following chart shows the mix of business between original equipment and aftermarket over the past decade:

The company does not provide operating income and margin data by product type but it is possible that certain aftermarket services and parts could command attractive margins relative to original equipment. On the other hand, the percentage of Joy Global’s sales attributable to aftermarket equipment has fallen in recent years during a period in which operating margins have been expanding which points to the opposite conclusion. However, the important point is that orders of new equipment could fall substantially in a recession but aftermarket parts and services probably will not and could potentially behave in a counter-cyclical manner if more customers choose to repair old machines rather than buy new ones.

Regional Results

The Euro-area is a basket case with the “core” countries barely treading water and the periphery firmly mired in recession. China may be on the brink of a serious slowdown, although few forecasters would predict an actual contraction in GDP. Meanwhile, the United States plods along with substandard GDP growth and the prospect of the “fiscal cliff” pushing the economy into recession in 2013. In light of these problems, let’s take a look at Joy Global’s results by region.

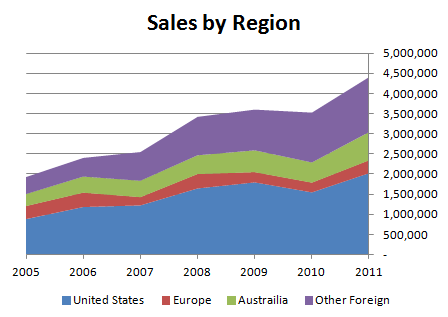

The following chart displays the company’s sales by region from 2005 to 2011. During most of this time frame, the United States accounted for between 45 and 50 percent of total sales. Europe has hovered at around 7 percent over the past three years with Australia between 14 and 16%. “Other Foreign” makes up the balance and has risen from 22 percent of total sales in 2005 to 35 percent in 2010 and 31 percent in 2011. It is likely that China is driving changes in “Other Foreign” revenue.

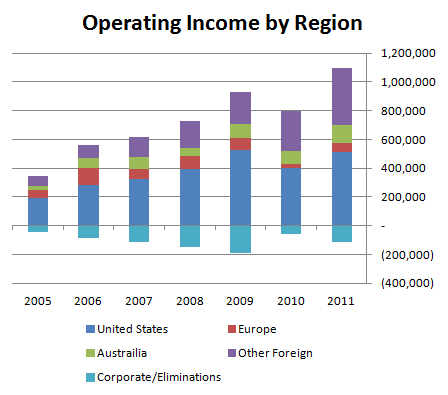

The following chart displays operating income by region:

We can conclude that the United States is clearly the most important market for Joy Global and that Europe is relatively insignificant in comparison. Although China is grouped in “Other Foreign”, the Australia region is also impacted by conditions throughout Asia and would be affected by a slowdown in China. It would be interesting to have a breakdown of original equipment vs. aftermarket by region but this is not available based on the company’s filings.

Cash Flow and Acquisitions

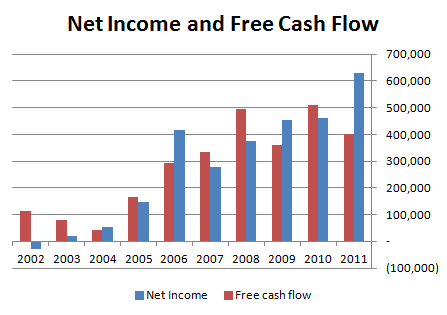

We compiled a record of Joy Global’s cash flow from fiscal 2002 to the first half of fiscal 2012 which ended on April 27, 2012. During this ten and a half year time frame, the company generated $3.2 billion of net income and $2.8 billion of free cash flow (with free cash flow calculated as operating cash flows less net purchases of property, plant, and equipment). Over this period, the company also issued nearly $1.3 billion in net debt. Dividends paid to shareholders accounted for $489 million with share repurchases (net of stock option related issuance) of $835 million. $2.4 billion was used for acquisitions (net of proceeds from dispositions).

The following chart displays free cash flow and net income over the past decade:

Clearly the trend is in the right direction and most net income converts to free cash flow over time. The company has devoted the majority of free cash flow along with considerable debt toward acquisitions with the most recent being the acquisitions of LeTourneau and International Mining Machinery (IMM). LeTourneau produces earth moving equipment and historically manufactured drilling equipment. Joy Global divested the drilling equipment division shortly after the acquisition.

IMM is a leading designer and manufacturer of underground coal mining equipment in China. Since the IMM acquisition was completed in early fiscal 2012, the financial results discussed in this article do not reflect IMM’s operations. IMM reported revenues of RMB 1,942 million ($306.3 million) and operating profit of RMB 417 million ($65.8 million) for its fiscal year ended December 31, 2010. Based on the purchase price allocation for IMM presented in Joy Global’s fiscal Q2 10-Q, the total cost was $1.4 billion. It remains to be seen whether this cash was allocated wisely but the purchase price certainly doesn’t seem cheap based on IMM’s 2010 results.

Risks

It seems clear that the current valuation of Joy Global is pricing in a significant decline in results. Although the company has demonstrated resiliency with respect to economic downturns in the past, a severe recession, particularly in the United States, could impact results given the fact that the United States is the company’s most important market. If an economic collapse, perhaps driven by the 2013 “fiscal cliff” also coincides with a further decline in natural gas prices, the shift from coal to natural gas electricity generation could accelerate.

There are many vocal bears when it comes to the Chinese economy. If China experiences an actual decline in GDP rather than a slowdown in growth for any extended period of time, Joy Global’s results will definitely be impacted and the performance of newly acquired IMM will suffer as well. Another major risk involves the potential for China to develop methods to harness advances in fracking to increase the production of domestic natural gas. Although China may face certain obstacles in tapping its shale resources (see The Economist’s survey referenced earlier), a breakthrough in natural gas production cannot be ruled out.

Although Europe is a small part of Joy Global’s business, the Euro-area seems on the verge of a meltdown (then again, this has been true for a couple of years now). Sales and operating income in Europe were hit hard in fiscal 2010 and this could easily happen again if the Euro zone falls apart in a disorganized manner.

Debt service has not been an issue for Joy Global in recent years, but it must be noted that significant debt is on the balance sheet due to the acquisitions described previously. In addition, the company has underfunded pension plans in place that should be treated as long-term debt when valuing Joy Global’s equity.

Summary

The market consensus clearly indicates that Joy Global should be classified as a traditional cyclical company and that its recent results are somewhere approaching “peak earnings”. Oddly enough, Wall Street’s “consensus” estimates disagree with this assessment and forecast higher earnings for fiscal 2012 and fiscal 2013.

It is almost certainly useless to come up with a macro forecast and probably useless to attempt to forecast Joy Global’s results with precision. However, a “back of the envelope” valuation could take a rough estimate of the company’s likely fiscal 2012 revenues ($5.4 billion run-rate based on first half results) and apply various operating margins to estimate operating income. Although operating margins have been above 20 percent recently, if we use a more conservative 17 percent, this would indicate operating income of about $900 million for fiscal 2012. Using a 8x multiple would lead to an enterprise value of $7.2 billion. Subtracting net debt of $1.25 billion and pension liability of $245 million leads to an equity valuation of $5.7 billion, or about $54 per share.

This “back of the envelope” exercise seems to indicate that Joy Global is not radically undervalued based on its recent price of around $50 per share. However, the assumptions used seem quite conservative, especially the 17 percent operating margin. If we use a 20 percent operating margin and leave all other variables the same, we would arrive at a valuation of about $68 per share, meaningfully higher than the current quote. It seems likely that if the world doesn’t completely fall apart, Joy Global represents a bargain at its current price. At the very least, the company is worth keeping on the radar as a potential opportunity in case emotionally driven selling occurs in a market panic.

Disclosure: No position in Joy Global.

********************************************************************************************

Note to Readers:

Readers may be interested in The Genius of Warren Buffett, a course offered by The University of Nebraska this fall over three weekends:

The Rational Walk is listing this event as a service to readers who may be interested and receives no compensation for resulting registrations.