Oil and gas wildcat exploration has never been for the faint of heart. Modern exploration techniques require significant capital investments and the regulatory climate has become more of a burden over the years. Even with advanced technology, projects are often more likely to fail than to succeed yet the lure of mineral riches is enough to attract significant capital to the industry. The long period of depressed natural gas prices has led many value investors to consider exploration and production (E&P) companies but often significant balance sheet risk exists which can reduce or eliminate downside protection.

In too many cases, taking a position in a E&P company is more of a speculation than an investment due to leverage, hedges requiring derivatives that are difficult to evaluate, and the prospect of significant dilution due to the use of stock options. In this article, we look at a unique E&P company that is conservatively run, free of leverage, hedges, and stock options, and offers investors a compelling value proposition at the current quote.

A Remarkable Success Story

Contango Oil & Gas Company is an independent natural gas and oil company focused on exploration, development, and production of resources primarily in shallow waters of the Gulf of Mexico. The company was founded in 1999 by Chairman Kenneth Peak and has compiled an remarkable track record over the past thirteen years.

Contango Oil & Gas Company is an independent natural gas and oil company focused on exploration, development, and production of resources primarily in shallow waters of the Gulf of Mexico. The company was founded in 1999 by Chairman Kenneth Peak and has compiled an remarkable track record over the past thirteen years.

Mr. Peak has been referred to as the “Warren Buffett of natural gas” and for good reason: With $79 million of invested capital, he has built a company with a recent market capitalization of $785 million and has returned over $115 million to shareholders through repurchases.

In mid-August, Contango announced that Mr. Peak would take a medical leave of absence for up to six months for exploratory tests and treatment related to a brain tumor. This was followed on September 11 with an announcement that Mr. Peak would liquidate a portion of his holdings in the company to “generate liquidity for estate and tax planning purposes.” There is no doubt that these are ominous press releases and the uncertainty associated with the situation has led to volatility and a decline in the stock price.

Before proceeding further, readers may be interested in a recent interview with Mr. Peak to get a sense of his views regarding Contango and recent market conditions. (RSS Feed subscribers may click here for a link to the video)

Bloomberg interview with Ken Peak on June 28, 2012

A Brief History of Contango

Mr. Peak founded Contango in 1999 by investing his entire life savings of $400,000 representing an “all in bet” on the company and providing the confidence for early investors to provide seed capital to begin operations. Between 2000 and 2007, the company raised an additional $55.5 million through five series of preferred stock which eventually converted to common stock. Although options were used in the past to compensate employees and directors, this practice was eliminated and the company currently has no options, 15.3 million shares of common stock outstanding and a market capitalization of $785 million.

A comprehensive history of Contango is beyond the scope of this article but investors may wish to review a brief history from Contango’s perspective that was published in 2010. It is also worthwhile to chronologically review the company description section provided in each of the company’s 10-K reports and 10-KSB reports. Doing so will reveal important changes in the nature of the company and its operations and is not very time consuming. We also recommend reviewing Contango’s informative presentations over the years and anyone contemplating an investment should ideally read all of the presentations in chronological order to understand the evolution of the company.

Fiscal 2008: A Pivotal Year

Although we are not presenting a comprehensive history, it is important to note that Fiscal 2008 (year ended 6/30/2008) was a pivotal year for Contango. Prior to 2008, the company had accumulated a portfolio of properties in the Fayetteville Shale region of Arkansas. In December 2007 and January 2008, Contango sold its interests in the Fayetteville Shale properties for $327.2 million recognizing a gain on sale of $262.3 million. In addition, the company sold its interest in a liquefied natural gas export terminal for $68 million which represented a gain on sale of $63.4 million.

At this point in time, Contango had also participated in a significant exploration program in the shallow waters of the Gulf of Mexico (GOM). In Fiscal 2007, the company and its partners were successful in finding oil and gas reserves which were named the Dutch and Mary Rose discoveries. Using the proceeds of the Fayetteville property sales, Contango increased its ownership interest in the Dutch and Mary Rose properties. The transactions were structured as a 1031 like-kind exchange for tax purposes which resulted in a large deferred tax liability (more on the significance of the deferred tax liability will be presented later).

In total, the company used $300 million of the Fayetteville proceeds to purchase these additional interests in Dutch and Mary Rose. In a press release on February 11, 2008, Mr. Peak stated that Contango was “100% focused on the Gulf of Mexico as we continue to study our strategic options and alternatives.” Although the company has participated in on-shore activities since 2008, the bulk of the value of Contango’s reserves and activity has been in the off-shore waters of the Gulf of Mexico ever since this pivotal shift.

For a brief period in calendar year 2007 and 2008, Contango was effectively put up for sale which is what the “strategic alternatives” in Mr. Peak’s February 11, 2008 memo refers to. Ultimately, the sale did not work out despite very high natural gas prices and Contango’s common stock price fell dramatically both in response to the lack of a transaction and the general stock market panic in the fall of 2008. It is clear now that a sale would have provided shareholders with a better outcome but it is less clear that failure to sell the company was an error based on information known at the time.

Contango’s Fiscal 2012 Results

Contango recently released its 10-K report for the fiscal year ended June 30, 2012 which we encourage readers to review. The company’s revenues of $179.3 million can be attributed primarily to the Dutch and Mary Rose wells with additional contributions from the Ship Shoal 263 (Nautilus) and Vermilion 170 (Swimmy) wells. The following table from the 10-K shows the average daily production from these wells expressed in MMcfed (millions of cubic feet equivalents per day) broken down by fiscal quarter:

For the entire 2012 fiscal year, the company produced 23,617 MMcf of natural gas, 615,000 barrels of oil and condensate, and 661,929 barrels of natural gas liquids. Each barrel of oil and natural gas liquids has the energy equivalent of 6 Mcf, so Contango’s total production can be expressed as 31,279 MMcfe. This represents a 3 percent decline in production from fiscal 2011.

In terms of energy content, 75.5 percent of Contango’s fiscal 2012 production came from natural gas, 11.8 percent from oil and condensate, and 12.7 percent from natural gas liquids.

During the year, the average sale price of natural gas was $3.10 per mcf, the average sale price of oil and condensate was $112.75 per barrel, and the average sale price of natural gas liquids was $55.44 per barrel. Since the price of natural gas is so low on an energy equivalent basis compared to oil and natural gas liquids, Contango realized only 40.8 percent of its total revenues from natural gas with oil and condensate making up 38.7 percent of revenues and natural gas liquids accounting for 20.5 percent of revenues. The company realized an average of $5.73 per mcfe, far higher than the price of natural gas, due to the much higher prices for oil and natural gas liquids on an energy equivalent basis.

The exhibit below shows the percentage of revenue and production attributable to each commodity type:

From this discussion, we can see that while Contango would have greatly benefited from higher natural gas prices, the high price of oil and condensate allowed the company to realize a price per mcfe of $5.73 for fiscal 2012 even though the price of natural gas averaged only $3.10 for the year.

In fiscal 2012, Contango had lease operating expense of $0.81/mcfe, general and administrative expenses of $0.33/mcfe, and depreciation, depletion, and amortization of $1.54/mcfe. The total costs per mcfe was $2.68 leaving the company with a pre-tax margin of $3.05 per mcfe on its production. On revenues of $179.3 million, the company posted $94.3 million in operating earnings and $58.4 million in net income, or $3.79 per share.

Contango’s fiscal 2012 results were respectable despite very low natural gas prices during the year due to a combination of the company’s production mix benefiting from the high price of oil and thanks to the low expense structure. If all of Contango’s production came in the form of natural gas, it would have realized a narrow $0.42/mcfe pre-tax margin and profitability would have been far lower as a result, holding all other variables constant. The following chart (click the chart to enlarge) was taken from a Contango presentation on January 3, 2012 and illustrates the company’s cost advantage relative to competitors:

We encourage readers to review management’s discussion and analysis in the latest 10-K for more information regarding the specific wells responsible for the year’s revenues along with additional details regarding costs and expenses. This brief summary only serves to illustrate Contango’s favorable revenue mix in terms of natural gas vs. oil as well as to point out the cost structure advantage. In conjunction, these two factors allow for profitability even during the current period of low natural gas prices.

Contango’s Reserves

While it is important to look at Contango’s recent operating history, it is more important to get a sense of the oil and gas reserves held by the company since this asset represents the bulk of the company’s intrinsic value. The most “obvious” place to look for the value of the company’s reserves is the property account on the balance sheet. As of June 30, 2012, Contango shows property, plant, and equipment of $396.3 million net of depreciation, depletion and amortization. The vast majority of this total is attributed to the company’s oil and gas reserves. Does it make sense to use this figure as a proxy for the value of the reserves?

The book value of an E&P company’s reserves is usually a poor indicator of the economic value of the reserves. This is because the property account is based on the company’s historical cost of acquiring or discovering oil and gas reserves rather than an estimate of the present value of future revenues expected from the reserves. Contango uses the “successful efforts” method of accounting which we discussed in more detail in another article. This is a conservative method of accounting that is fairly likely to understate true economic value.

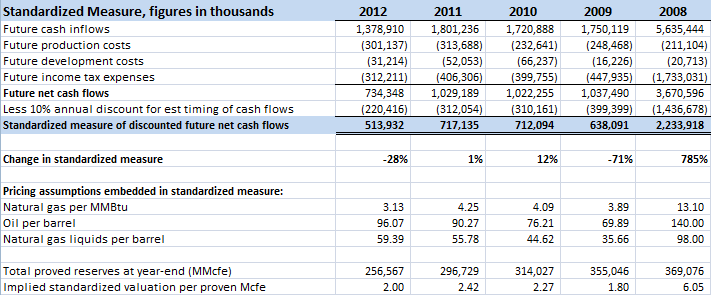

In an attempt to provide financial statement users with a more realistic estimate of the value of oil and gas reserves, the SEC requires E&P companies to calculate a “standardized measure” of reserves based on recent commodity pricing, the expected timing of production activities, and an estimate of future costs of production. The net cash flows from the estimate is discounted at 10 percent to arrive at an after-tax figure. The value of Contango’s reserves based on the standardized measure was $513.9 million as of June 30, 2012. The pricing assumptions used in the calculation were: $3.13/mcfe for natural gas; $96.07/barrel of oil; and $59.39/barrel of natural gas liquids. Total proved reserves as of the date of the calculation were 256,567 MMcfe.

There is a $117.6 million difference between the company’s book value of reserves and the value based on the standardized measure. Obviously, if natural gas prices rise from currently depressed levels, the standardized measure would also rise accordingly. The following exhibit illustrates how volatile the standardized measure can be based on the pricing assumptions that are embedded in the calculation (click on the exhibit for an enlarged view):

Value of Deferred Tax Liability

As mentioned above, Contango has had a significant deferred tax liability on the balance sheet since entering into a like-kind 1031 exchange in which its Arkansas Fayetteville shale assets were exchanged for increased interests in the Dutch and Mary Rose discoveries. The deferred tax liability was $118 million as of June 30, 2012. Of this amount $112 was deferred based on the 2008 like-kind exchanges.

If Contango were to sell its interests in the Dutch and Mary Rose wells that were acquired via the like-kind exchange, the company would realize a gain or a loss on sale based on the cost basis of the Fayetteville assets sold in 2008. In a hypothetical scenario where Contango sold these interests tomorrow, the company could potentially owe the $112 million that was deferred in 2008 provided that the proceeds from the Dutch and Mary Rose sales were sufficiently high. However, if Contango does not sell the Dutch and Mary Rose properties and eventually fully depletes the reservoirs, these properties will be plugged and abandoned rather than sold. The value of the properties would have been recognized in depreciation and depletion expenses over the years of production and would eventually be worthless. In this scenario, it does not appear that Contango would owe the $112 million in deferred taxes. As a result, we prefer to heavily discount the deferred tax liability on the books to reflect its “true” likely value.

Obviously, we do not have sufficient insight into knowing if or when the tax will be due so the true value is necessarily subjective. However, even if one assumes that the full $112 million will eventually be paid, clearly its present value is still lower than the liability on the balance sheet.

Cash and Capital Expenditures

As of June 30, 2012, Contango had nearly $130 million of cash on the balance sheet and no debt outstanding. The company has a $146.7 million capital expenditure program planned for fiscal year 2013 ending on June 30, 2013. These projects are expected to be funded from cash on hand and cash flow from operations. A summary of these prospects is listed below:

In addition to the “Eagle” and “Fang” wildcat prospects in the Gulf of Mexico, Contango has budgeted to drill two additional wildcat wells in the gulf along with significant funding for the Exaro and Alta joint ventures which are land based drilling programs. We will not go into detail here regarding the nature of these prospects other than to suggest that some will almost certainly result in “dry holes”. That is the nature of exploration and production and is to be expected. However, Mr. Peak seemed optimistic regarding the prospect of finding significant new reserves in a press release dated June 25, 2012.

Valuation

The ultimate value of Contango is heavily dependent on the future direction of oil and natural gas prices. As we noted previously, even in an environment of low natural gas prices, Contango is able to realize an attractive selling price per mcfe due to the company’s oil and natural gas liquid production. Contango shareholders clearly hope that the historically low price of natural gas relative to oil is corrected by a rise in natural gas prices but there is no guarantee that the correction will not come in the form of lower oil prices. Ultimately, investors in E&P companies have to want exposure to the underlying commodities in order to consider an investment.

Our approach for estimating Contango’s intrinsic value involves starting with the company’s stated shareholders’ equity figure of $464.3 million and making appropriate adjustments.

The first adjustment involves considering the true value of reserves versus book value of reserves due to the reasons mentioned previously. If we decide to use the standardized measure as a proxy of value, we would need to add $117.6 million to book value. However, recall that the standardized measure was calculated based on a very low natural gas price of $3.13/mcfe. This price is based on an average of monthly prices during fiscal 2012 and its use in the standardized measure essentially predicts that pricing will not change for the life of Contango’s reserves. Despite the gloomy sentiment in natural gas, the market does not agree with this assumption based on futures pricing as we can see from the following chart showing futures prices for natural gas:

In the past, Contango has provided an estimate of reserve value based on futures strip pricing (non-GAAP) but this has not been provided in the recent past. Users of financial statements are not provided with sufficient data to plug in different assumptions to the standardized measure to obtain alternate estimates. As a very rough proxy, however, we would point to the previous table showing Contango’s standardized measure in prior years when natural gas prices were stronger. For example, in 2011, the standardized measure was $717.1 million albeit on somewhat higher proved reserves.

Ultimately, some discretion must be used but clearly any estimate consistent with market expectations would have to be higher than the standardized measure. We have chosen to use a reserve valuation of $750 million which is admittedly not based on an exact calculation but appears defensible if natural gas trades in the $4-5 range over the next several years as the market expects. As a result, we will adjust book value upward by $354 million ($750 million – $396 million) based on our estimate of true reserve value versus book value.

We also believe that it is appropriate to adjust book value based on the likelihood that the deferred tax liability of $112 million originating from the like-kind exchange will not be fully owed and that whatever amount owed will not be paid for several years. While admittedly arbitrary, we assume that only half of the deferred tax liability is likely to be an economic liability and therefore we add $56 million to book value.

The result of our estimate is to take stated book value of $464.3 million and adjust it upward for $354 million in additional reserve value and $56 million for the lower economic value of the deferred tax liability. This results in an intrinsic value estimate of $874.3 million, or approximately $57 per share compared to the current quote of $51.32/share.

We should note that we have assigned zero value to future discoveries in this valuation not because we doubt that there will be future discoveries but because we do not know of a good way to estimate their value. In other words, the $57/share valuation essentially boils down to an estimate of the value of Contango’s remaining reserves assuming somewhat better natural gas pricing (but no better than reflected in futures markets) in a scenario where management decides to wind down the firm and cease new exploration. To the extent that new exploration adds value, intrinsic value will be higher than our estimate. Obviously, this cuts both ways and future exploration could destroy value.

Risks and Conclusion

As we mentioned previously, dark clouds are looming over Contango with Ken Peak’s medical leave and subsequent sale of 250,000 shares of stock due to tax and estate planning requirements (which was completed on September 20 based on SEC filings). After the recent sale of stock, Mr. Peak continues to control 13.3 percent of Contango. Mr. Peak’s importance to Contango is self evident based on the company’s track record of creating value and his value to the company cannot be replaced. Although we obviously hope that Mr. Peak returns as CEO and runs the company for many more years, it is prudent to consider the scenario if a less favorable outcome occurs.

Mr. Peak has been replaced as CEO on a temporary basis by Brad Juneau. Mr. Juneau is the managing member of Juneau Exploration LP which has been an exploration partner of Contango almost since the company’s inception. Contango outsources essentially all exploration functions to partners and Juneau Exploration has been the most important partner historically.

Space constraints prevent us from going into the details of the partnership here but the information is available in Contango’s latest 10-K. Our observation is that Mr. Juneau’s long history working with Contango would be a positive factor if he ends up replacing Mr. Peak as CEO on a permanent basis. However, the extensive list of related party transactions outlined in the latest 10-K present significant potential conflicts of interest. These conflicts could be dealt with most cleanly if Contango purchases Juneau Exploration. However, the terms of such a transaction, if it is even agreeable to Mr. Juneau, are obviously unknown.

Whether Mr. Juneau or another individual takes over as CEO, it is quite likely that a new CEO would have to be paid far more than Mr. Peak has been paid historically. This could include stock options or other dilutive instruments. Until recently, Contango has operated with a staff of under ten employees and this bare bones operation probably reflects Mr. Peak’s personality and position as a major shareholder.

If no deal can be struck with Mr. Juneau, it is also possible that the company may put itself up for sale rather than seek new leadership. If so, the company would be sold under today’s natural gas pricing environment and our intrinsic value estimate could be too optimistic.

Despite the risks outlined here, we find the risk/reward situation compelling for several reasons. First, Contango is one of the only E&P companies we know of that has no debt, no hedges, and no potentially dilutive securities outstanding. In most E&P companies, an equity investor could very well lose his entire investment due to the presence of leverage. Even an adverse outcome for Contango is not going to wipe out equity holders. Second, Contango is trading below what we believe to be a conservative estimate of the economic value of reserves based on only a mild improvement in natural gas pricing. Third, we have given no credit to the company for its current exploration program which is likely to add incremental value based on the company’s track record.

In summary, Contango is a potentially interesting investment and a compelling risk/reward situation with an important caveat: The investor must want exposure to natural gas and oil and be willing to bear the consequences of severe adverse developments in commodity prices. Those who do not seek such exposure should not consider Contango or any other E&P company.

Disclosure: Individuals associated with The Rational Walk LLC own shares of Contango Oil & Gas Company.