This is the fifth in a series of articles covering “unpopular” larger companies. Benjamin Graham believed that such companies may present opportunities for enterprising investors. We discussed the Graham approach in more detail in a recent article.

One of the central tenets of value investing is that one must always insist on a large margin of safety before allocating capital. When investor sentiment is favorable toward an industry or a company, prices of securities are usually bid up to a level where everything must go according to plan in order to achieve expected investment returns. On the other hand, negative sentiment can sometimes, but not always, offer an investor opportunities to make commitments offering high returns and low downside risk.

In this article, we profile Diamond Offshore, one of the leading companies in the deepwater drilling industry. In previous articles, we focused on two companies in the offshore drilling industry with lower risk profiles. Both Noble Corporation and Ensco plc have exposure to deepwater drilling in the Gulf of Mexico but also have significant international operations along with large fleets of jackup rigs that are designed for less controversial shallow water drilling.

The main reason that Diamond Offshore was not profiled in the past is because the company is far more exposed to deepwater drilling and could face more regulatory uncertainty as a result. The goal of the articles on Noble and Ensco was to identify companies that had enough diversity in operations, both in terms of shallow water and international operations, to successfully deal with an extended (or even permanent) U.S. moratorium on deepwater drilling. With this caveat, let us briefly examine Diamond Offshore’s business.

Overview

Diamond Offshore is one of the leading global providers of contract drilling services and operates a fleet of 47 offshore rigs comprised of 32 semisubmersible rigs capable of deepwater operations, 14 jackup rigs designed for shallow water drilling, and one drillship. The company is well diversified by region with 68 percent of 2009 contract drilling revenues originating from outside the United States. Revenues are heavily tilted in favor of deepwater operations with only 12.9 percent of 2009 revenues coming from the jackup fleet. For a brief primer on the differences between rig types, please refer to our previous article on Noble Corporation. The following exhibit presents a snapshot of Diamond Offshore’s valuation as of July 15, 2010.

In contrast to Ensco and Noble which both trade at small premiums to tangible book value, Diamond Offshore commands a larger premium which is most likely due to the long term projected earnings power generated by a more advanced fleet capable of the higher dayrates that deepwater operations command.

The company has a small regular dividend but has been paying out large special dividends in recent years. The total dividend paid in 2009 was $8 per share. As we can see from the exhibit below, the company has been generating in excess of $1.1 billion of free cash flow over the past two years and has distributed much of this to shareholders. Debt levels appear manageable at approximately 29 percent of total capital, although debt was increased by approximately $1 billion during 2009 to fund expansion capex.

Operating Data Snapshot: 2007 to 2009

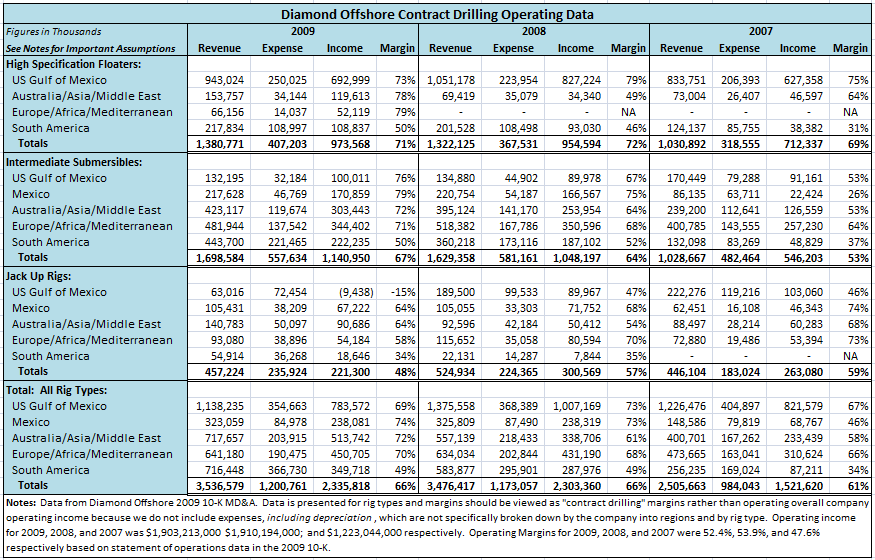

Although Diamond Offshore operates in a single segment, the company provides more data than many competitors regarding the composition of revenues, expenses, and operating income between rig type and region. The exhibit below is a reorganization of the data presented within the company’s MD&A section of the 2009 10-K report. Please click on the image to enlarge it.

The exhibit breaks down operating data for contract drilling by rig type and then by geographic region. Both high specification floaters and intermediate semisubmersibles are generally designed for deepwater activities, although in some cases they may be repurposed for shallow water drilling. All jackup rigs are limited to shallow water drilling. The vast majority of the company’s revenues and operating profits can be attributed to rigs designed for deepwater operations.

Gulf of Mexico Exposure

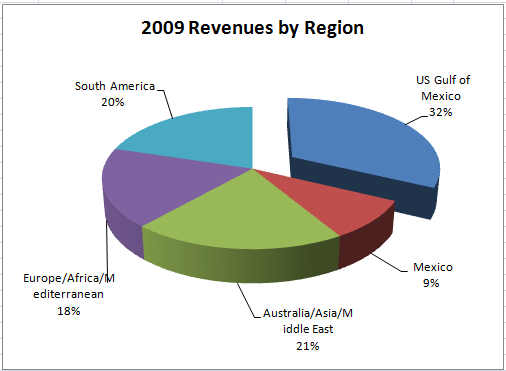

The chart below shows the breakdown of 2009 contract drilling revenues by region and includes revenues from all rig types. The segment that is broken out shows that 32 percent of total contract drilling revenues are from operations in the United States Gulf of Mexico.

Within the U.S. Gulf of Mexico, the vast majority of 2009 revenues were attributed to rigs capable of deepwater operations.

Only 5 percent of revenues from the Gulf of Mexico were from jackup rigs and the vast majority were from high specification floaters representing some of the most advanced rigs in Diamond Offshore’s fleet.

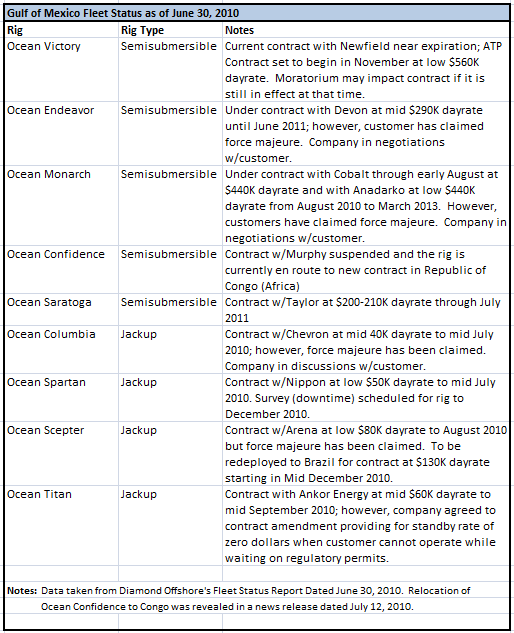

According to the June 30, 2010 fleet status report, Diamond Offshore currently has nine rigs in the Gulf of Mexico. Five of the rigs are semisubmersible units. On July 12, the company announced that Ocean Confidence, one of the semisubmersible rigs, would immediately redeploy to the Republic of Congo. The following exhibit provides a summary of the latest information regarding the Gulf of Mexico fleet.

As we can see, several customers have invoked force majeure in an attempt to exit or modify existing contracts. Presumably, this is due to the Obama Administration’s moratorium on deepwater drilling although it is notable that the Ocean Titan is on a standby rate of zero dollars due to regulatory difficulties even though it is a jackup rig. The relocation of Ocean Confidence out of the Gulf of Mexico could presage similar actions for other rigs if regulatory difficulties continue. However, relocation can be expensive and time consuming and there is a possibility that mass relocations of rigs from the U.S. Gulf of Mexico could depress dayrates elsewhere in the world.

Summary

In contrast to our previous studies of Noble Corporation and Ensco, it seems clear that Diamond Offshore carries more business risk due to the higher concentration of revenues in deepwater activities in the U.S. Gulf of Mexico. These risks may be mitigated to some extent through the relocation of assets to other parts of the world and negotiations with customers. However, it is clear that investors in Diamond Offshore have a great deal to lose if the deepwater moratorium is extended or made permanent.

At the current valuation, Diamond Offshore certainly appears inexpensive compared to the market prices that prevailed before the Deepwater Horizon disaster. However, Noble Corporation seems far cheaper both in terms of multiples of earnings and free cash flow as well as the price to tangible book ratio. A similar observation can be made regarding Ensco.

It must be acknowledged that Diamond Offshore’s fleet may legitimately command a premium valuation compared to Noble and Ensco in a world where deepwater exploration is robust and premiums are placed on advanced semisubmersible rigs. However, the flip side is that they are more exposed to adverse regulatory developments in deepwater. An investment in Diamond Offshore may turn out well at current market prices and may even offer more upside potential than Noble or Ensco, but much depends on a reasonably quick return to deepwater exploration in the Gulf of Mexico.

Resources

Diamond Offshore 2009 10-K

Diamond Offshore 2010 Q1 10-Q

Diamond Offshore Fleet Status Report as of June 30, 2010 (Excel)

Press Release on Ocean Confidence Relocation

Disclosure: No position in Diamond Offshore or Ensco. Long Noble Corporation.