Many aspects of life seem to have asymmetrical qualities. One obvious example involves the amount of time and effort required to build a reputation, both from a personal and professional perspective. It can take many years to earn the confidence needed to be considered trustworthy by friends and family, and the same is even more true in a professional setting. However, it only takes one serious breach of confidence to ruin a reputation, no matter how much time was spent building it. As Warren Buffett has often said, it can take twenty years to build a reputation but only five minutes to lose it.

What is true for individuals is also true for a business, particularly those that are built on brand loyalty. It is even more true for a business that we entrust with our personal health and well being. Although we do not think about it until there is a well publicized problem, consuming food prepared by others requires trust, and trust is based on reputation. Perfection is impossible and it is inevitable that a restaurant company operating thousands of locations will make mistakes leading to occasional food poisoning. This has always been the case. However, prior to the era of social media, news about such incidents traveled more slowly and never “went viral” as it does today in Facebook and Twitter feeds. Social media has created an even greater asymmetry between the work required to build a reputation and the lapses sufficient to ruin it.

Well publicized cases of food poisoning at certain Chipotle restaurants in late 2015 took a major toll on the company’s reputation and financial results in 2016 reflected significant damage to the brand. We discussed Chipotle’s difficulties in an article last October in some detail, with a focus on the initial outbreak and the financial impact over the first half of 2016. We also examined Chipotle’s previously attractive expansion economics and overall track record. The key question at the time was whether the damage to the brand was temporary or permanent.

Chipotle released full year results for 2016 last week and it seems like an opportune time to revisit the situation. As investors, we seek out asymmetry when making decisions regarding where to commit capital. We are looking for situations where there is a significant amount of upside and where enough downside protection exists to limit permanent loss of capital if things go wrong. An open question at this point is whether the significant decline in Chipotle’s stock price has provided enough downside protection for shareholders if the brand does not fully recover. The related question is what kind of upside might exist if management’s turnaround succeeds.

Evaluating Chipotle’s Financial Performance

In our prior article, we presented quite a bit of financial data for Chipotle over the past decade and readers might want to take a look at that information before proceeding. In this section, we will first take a brief look at key metrics for 2016 as they relate to prior year results. However, due to the rapidly changing situation at the company, looking at full year results is not really sufficient to get a picture of the progress that has been made dealing with the crisis over the past year. In order to do that, we must look at quarterly results. Finally, we need to decide whether management’s guidance for 2017 makes sense given recent trends.

Full Year 2016 Results

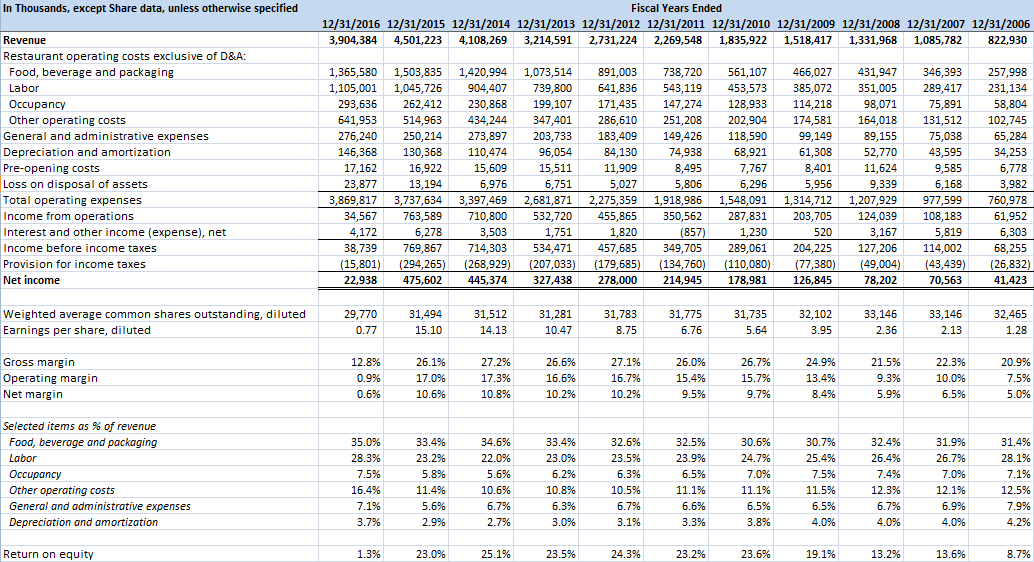

Chipotle’s full year results were dismal, as expected, with comparable restaurant sales declining 20.4 percent and overall revenue declining 13.3 percent. Operating metrics collapsed with gross margin declining from 26.1 percent to 12.8 percent. Average sales per restaurant declined to $1.8 million from $2.4 million in 2015. Profitability all but vanished, as reflected by an operating margin under 1 percent, down from 17 percent in 2015. However, management did not slow expansion activity. 240 stores were added bringing the total restaurant count to 2,250, and there are plans to open between 195 to 210 restaurants in 2017.

The exhibit below provides a long term view of Chipotle’s income statement as well as the key operating metrics that drive profitability (click on the exhibit for a larger view):

We can see the 30,000 foot view of the effects of the crisis here and quickly spot the reasons for the deterioration in profitability:

- Food, beverage and packing costs increased from 33.4 percent of revenue to 35 percent of revenue primarily because of the costs associated with improved food safety procedures, some of which generated additional waste and inefficiency.

- Labor costs increased from 23.2 percent of revenue to 28.3 percent of revenue primarily due to sales deleveraging. As revenue per restaurant declined, the company suffered from lower productivity. In addition, employee costs associated with sales promotions and staffing for new restaurants inflated overall spending.

- Occupancy costs are basically fixed in nature and increased as a percentage of diminished revenue. As a result, occupancy rose from 5.6 percent of revenue in 2015 to 7.1 percent of revenue in 2016.

- Other operating costs increased dramatically primarily due to higher marketing and promotional expenses. Management spent $103 million on advertising and marketing in 2016 compared to $69.3 million in 2015. As a result, other operating costs rose to 16.4 percent of revenue in 2016 from 11.4 percent of revenue in 2015.

The past year probably seemed like an eternity for Chipotle’s management team and looking at year-over-year results really isn’t very useful for analysts either given the circumstances. What we really should care about is how the trends played out over the course of 2016. Was there significant improvement as the year progressed?

A More Granular View

The exhibit that appears below is essentially the same as what we presented above but rather than looking at annual results, we have provided the relevant statistics for the past eight quarters. The food safety crisis began partway through the fourth quarter of 2015 (click on the image for a larger view):

We should view the first three quarters of 2015 as the “steady-state” prior to the crisis, with the fourth quarter of 2015 as the transitional month and all of 2016 as the recovery. All of the elements of gross margin, discussed above, can be analyzed accordingly, and we won’t repeat all of the quarter-to-quarter narrative provided in the company’s quarterly earnings releases. If our goal is to gauge the overall state of the recovery, the key metrics to focus on are the changes in comparable restaurant sales and restaurant level operating margin:

- Comparable restaurant sales represent our best way of understanding the damage to Chipotle’s brand among existing customers because it removes the effect of new restaurant openings that might bias analysis of overall changes in revenue. We can see that the sequential trend has shown some improvement. The effects of the crisis were immediately apparent with a 14.6 percent decline in Q4 2015 and a nearly thirty percent decline in Q1 2016, but since that point, we have seen some improvement. We should bear in mind the fact that the 4.8 percent decline in Q4 2016 was compared to an already weakening result for Q4 2015.

- Restaurant level operating margin is different from overall operating margin. It represents total revenue less restaurant level operating costs, expressed as a percentage of revenue. It is effectively a measure of store profitability excluding corporate overhead. Prior to the crisis, restaurant level operating margin was in the 27-28 percent range. After a particularly weak first quarter, this measure has recovered but was still roughly half of pre-crisis levels, at 13.5 percent in Q4 2016.

Management’s Forecasts

Management has provided a number of forecasts regarding operating results for 2017, both in the company’s recent 10-K filing and in the latest conference call. Although best taken with a grain of salt, the key forecasts are as follows:

- Comparable restaurant sales are forecast to increase in the “high single digits” for the full year.

- Restaurant operating costs as a percentage of revenue are expected to decline for the full year, with food, beverage and packaging costs decreasing to the “low 34 percent range” due to more favorable food management and lower avocado prices. Advertising and marketing spending is expected to decline to about 3 percent of sales for the full year compared to 4.7 percent of sales in Q4 2016. Occupancy costs are expected to decline to “just over 7 percent of sales”.

- Restaurant operating margin in the 20 percent range was characterized as a “stretch goal” that is achievable based on current sales volume. Management believes that if average sales per restaurant can return to the ~$2.5 million range that prevailed prior to the crisis, restaurant operating margin could return to the 26-27 percent range, or higher, implying that restoration of pre-crisis economics is not out of the question but unlikely to occur in 2017.

- Earnings per share of $10 as a “stretch goal”.

Are these goals realistic? Well, that is the million dollar question at the moment and it is difficult to know based on an extrapolation of the recovery seen up to this point. During the conference call, CFO John Hartung provided some insight into trends that were seen in January 2017 and the overall news seems to be positive:

During December, we recorded positive monthly comp of 14.7%, which includes a 60 basis point benefit for deferred revenue related to Chiptopia. The sales comparisons ease in January as we’re comparing to a down 36% versus a down 30% in December of 2015.

But the dollar sales trends continued from December into January, and the January preliminary comp improved to 24.6%, which included a negative trading day of over 100 basis points, slightly offset by 20 basis points positive related to Chiptopia. For the first 28 days in January, the comp was 26%. But in the last three days of January, we traded a Friday and Saturday from last year, two of our highest volume days, for a Monday and Tuesday this year, two of our lowest volume days of the week.

Of course winter weather in January often results in choppy trends day-to-day and week-to-week, but when we analyze the underlying comp trends, the January sales held up well, especially considering January had the lowest promotional activity of the past 12 months. We’ll compare against a comp of down 26% in February and March, so expect the comp will ease accordingly during the rest of the quarter.

In order to achieve the “stretch” goal of restaurant level operating margin of 20 percent and earnings per share of $10, it seems like management must execute on all cylinders throughout the year. Earnings per share of $10 implies net income of close to $300 million and pre-tax income of around $500 million. Management has not provided a total revenue forecast for 2017, but they have indicated that comparable restaurant sales should increase in the high single digit range and there are plans to open around 200 restaurants during the year. If this results in total revenue in the $4.3 billion range, $500 million of operating income implies an operating margin of around 11.6 percent. This would be far below the pre-crisis operating margin in the ~17 percent range but a big improvement over the 3 percent operating margin posted in Q4 2016.

Margin of Safety

As investors, the asymmetrical deal we are looking for is uncapped upside potential with limited risk of permanent loss of capital. Does Chipotle represent such an opportunity? Is there a reasonable margin of safety for those who purchase shares around $410?

Chipotle has always traded as a “growth stock” with a very high market capitalization relative to trailing earnings. Investors have been willing to pay up for the shares due to the attractive expansion economics demonstrated over many years (which we described more fully in our previous article). Expansion was made possible due to the power of the Chipotle brand coupled with the capabilities of management to grow the business efficiently.

While management’s capability is not in question, the resiliency of the brand is very much in doubt. It is not so much a question of whether the brand will survive. Recent sales trends demonstrate that the company has the ability to remain profitable. Key metrics have shown improvement. Memories do not last forever and customers will return. The major question for investors is instead whether the pre-crisis economics can be restored for existing stores and whether sufficient expansion opportunities exist to keep the growth going in the future.

Management has set a “stretch” goal implying the possibility of earnings per share in the $10 range for 2017. Shares are trading at over 41 times that stretch goal. The goal itself is highly questionable given that the implied operating margin required to achieve it is far higher than what has been demonstrated in the recent past. Management has not increased prices in three years and currently has no plans to do so. As a result, all of the margin improvement is going to have to be delivered through various forms of cost efficiencies. This is a tall order, and it doesn’t even get the company back to pre-crisis economics.

At the same time, the company might be running out of good expansion opportunities. With a presence in most metropolitan areas, Chipotle might have to select poorer locations in the future that could fail to deliver the unit economics of existing locations. International expansion is in its infancy and attempts to expand the Chipotle operating model to other brands has not gained traction, as evidenced by management’s abandonment of the ShopHouse concept. The company’s foray into “better burgers” with the Tasty Made concept has generated lukewarm reviews at its first location which opened last year.

Conclusion

Chipotle’s management could very well turn around the Chipotle brand and restore pre-crisis economics, continue expansion of the brand, and even extend its operating model to other concepts. However, it is also very possible that Chipotle never regains the economics of the past.

Market participants appear to have priced in a significant amount of recovery potential into the shares already. It is not difficult to project scenarios where 2017 earnings could be less than half of the stretch goal that management has set. If that ends up happening, the market could lose confidence in management’s ability to engineer a recovery and resume growth. If investors end the year looking at a company that has earned only $5 per share (as an example), and has less exciting prospects for growth, a share price of $400 would be untenable.

It is easy to see downside in excess of fifty percent if things do not go well this year while upside is more modest because the market has already given management the benefit of the doubt. From a value investing standpoint, it seems better to observe from the sidelines and remain ready to act if the market does mark down the shares substantially.

Of course, there are plenty of successful investors who completely disagree with this assessment. Bill Ackman’s Pershing Square Capital Management has maintained its large investment in Chipotle and now is represented by two members of the company’s board of directors.

Disclosure: No position in Chipotle.