Noble Corporation recently announced second quarter 2010 earnings of $218 million, or $0.85 per share. The results were negatively impacted by a combination of lower utilization for the overall fleet and sharply lower average dayrates. As a result, contract drilling revenues dropped to $687.5 million for the second quarter compared to $808.6 million for the first quarter. Second quarter 2009 contract drilling revenues were $868.2 million.

Noble Corporation recently announced second quarter 2010 earnings of $218 million, or $0.85 per share. The results were negatively impacted by a combination of lower utilization for the overall fleet and sharply lower average dayrates. As a result, contract drilling revenues dropped to $687.5 million for the second quarter compared to $808.6 million for the first quarter. Second quarter 2009 contract drilling revenues were $868.2 million.

We profiled Noble in some detail in early June when the shares traded at approximately $28. After significant volatility in trading today, Noble shares closed up 4.6 percent at $32.06 on the earnings news despite failing to meet analyst estimates. In this article, we will take a closer look at Noble’s quarterly results with particular attention devoted to trends on dayrates and Noble’s changing mix of revenues by rig type.

Revenue Trends by Rig Type

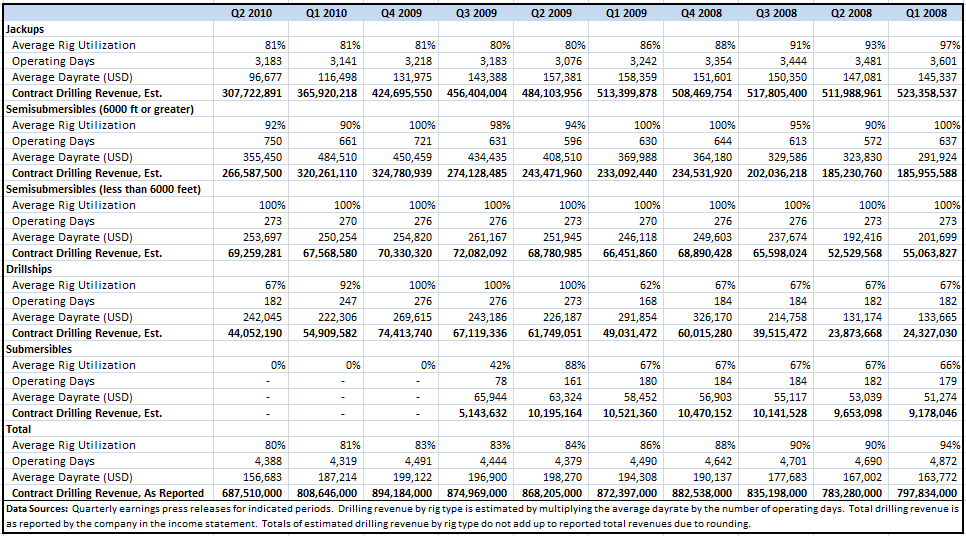

It is helpful to examine Noble’s revenue by rig type over the past ten quarters to get a feel for the dayrate and utilization trends. The exhibit below provides average rig utilization, operating days, average dayrates, and contract drilling revenue for each rig type (click on the image to enlarge it).

Several facts are readily apparent from reviewing the data in the exhibit:

- Jackup revenues are clearly in a declining trend due to a combination of lower utilization and eroding dayrates. The average dayrate in the second quarter was $96,677, far lower than the dayrates in the $140,000 to $160,000 range that prevailed during 2008 and the first three quarters of 2009.

- During 2009, semisubmersible rigs capable of drilling in waters over 6,000 feet produced higher revenues that largely offset the decline in jackup fleet revenues. However, dayrates for these rigs have been under pressure during the second quarter.

- Overall fleet utilization has dropped from 94 percent to 80 percent over the ten quarter period.

The following chart shows the revenue contribution of each rig type in a more visually intuitive format and clearly highlights the diminishing contribution of the jackup fleet and the growing importance of sophisticated semisubmersible rigs:

Drilling down to the revenue for the second quarter, the chart below shows the contribution of each rig type to overall contract drilling revenues:

Clearly, the negative sentiment surrounding the Deepwater Horizon disaster and the Federal Government’s regulatory response has taken a toll on Noble’s second quarter results, but it is also important to note that the decline in overall revenues actually began in earnest during the first quarter prior to any hint of difficulties in the Gulf of Mexico. The notable change in the second quarter is the precipitous drop in average dayrates for both advanced semisubmersible units and jackups.

Despite the negative trends that have taken shape so far this year, Noble posted net income of $589 million, or $2.28 per share, for the first half. During the first half, the company generated slightly over $1 billion in net cash from operating activities while investing $490.7 million in new construction and other capital expenditures. Also, at the end of the quarter, Noble announced the acquisition of Frontier Drilling and a significant agreement with Shell.

Outlook

Noble held a conference call (available for replay at this link through July 27, or read the transcript) for investors today and most of the questions in the Q&A session were related to the outlook for dayrates and utilization in the wake of the negative regulatory climate caused by the Deepwater Horizon disaster. The company also released a fleet status report (pdf) on July 8.

While the company has been able to secure additional work for several jackup units around the world, it is notable that the extensions generally have lower dayrates. With the exception of the Noble Roy Butler in Mexico and the Noble Hans Deul in the North Sea, all of the newly announced contracts for jackup rigs are at lower dayrates than the contracts they replace. In some cases, the new dayrates are dramatically lower: For example, the Noble Gene Rosser in Mexico was on a dayrate of $171,000 until June 19 and was recently extended through December 2010 at a dayrate of $80,000.

The deepwater situation in the Gulf of Mexico remains uncertain due to the moratorium as well as questions regarding the higher cost structure that will inevitably come from tighter regulations if operations are allowed to resume. The good news is that Noble has been able to negotiate standby agreements with most customers. The bad news is that the standby dayrates are substantially lower than operational dayrates and appear to limit the ability of the company to relocate rigs to other parts of the world. Additionally, the company is involved in litigation with Anadarko over a force majeure dispute regarding the Noble Amos Runner. While the litigation is in progress, Noble is not collecting the $440,000 dayrate for the Amos Runner, although some recovery might be possible in the event of a favorable court ruling.

Summary

There is no doubt that Noble Corporation has suffered along with the rest of the offshore contract drilling industry due to the regulatory uncertainty in the Gulf of Mexico and what appears to be a general trend toward lower dayrates particularly in the jackup fleet. However, despite these setbacks, the company remains highly profitable and was able to leverage a strong balance sheet in an opportunistic acquisition of Frontier that doubles contracted backlog going forward. This acquisition should close by the end of July.

Whether Noble represents a good investment at current prices depends greatly on the investor’s time horizon and tolerance for price fluctuations in the short run. The $8.2 billion market capitalization of the company compares favorably to free cash flow that is likely to exceed $1 billion this year. With an eventual recovery in dayrates and the contribution of the Frontier acquisition, free cash flow should eventually exceed the peak levels of 2009.

While the most prominent risk to the bullish thesis at the moment is the regulatory climate, the larger economic risk would be associated with a period of sustained low oil prices that would make deepwater exploration uneconomical. However, with energy use in the developing world growing rapidly (For example, China recently surpassed the United States in energy usage), it seems highly unlikely to expect oil prices to drop significantly over the next five to ten years.

Disclosure: The author owns shares of Noble Corporation.