Note to Readers: In this article, we briefly discuss selected aspects of Berkshire Hathaway’s 2010 results based on today’s release of Berkshire’s 2010 annual report (pdf). Earlier today, we discussed the highlights of Warren Buffett’s annual letter to shareholders. Next week, we will publish The Rational Walk’s comprehensive report on Berkshire Hathaway, In Search of the Buffett Premium, which is currently available for pre-order.

Berkshire Hathaway’s book value per share grew by 13 percent in 2010, slightly behind the 15.1 percent total return of the S&P 500, and stood at $95,453 per A share as of December 31, 2010. Although Warren Buffett and many Berkshire shareholders believe that Berkshire’s intrinsic value far exceeds book value, changes in book value for any given year may be considered a rough proxy for intrinsic value progress.

Berkshire Hathaway’s book value per share grew by 13 percent in 2010, slightly behind the 15.1 percent total return of the S&P 500, and stood at $95,453 per A share as of December 31, 2010. Although Warren Buffett and many Berkshire shareholders believe that Berkshire’s intrinsic value far exceeds book value, changes in book value for any given year may be considered a rough proxy for intrinsic value progress.

Over the past 46 years, Berkshire’s book value has fallen short of the S&P 500’s return on only eight occasions and has compounded at an amazing 20.2 percent annualized rate. During this timeframe, Berkshire’s stock price advanced at a more rapid rate than book value (from around $18 in 1965 to $127,550 at Friday’s close). To put this in perspective, a consumer who invested the cost of a new Ford Mustang ($2,368) in Berkshire shares in 1965 would today have shares worth in excess of $16.7 million.

In this article, we take a brief look at Berkshire’s overall results for 2010 and present a few pieces of interesting information regarding Berkshire’s insurance and diverse manufacturing, retail, and service groups. Space and time considerations preclude coverage of Berkshire’s other important subsidiaries all of which receive comprehensive coverage in our forthcoming report.

Firing on All Cylinders After Recession

Although most headlines focus on Berkshire’s net income figures, it is more useful to focus on net income excluding investment gains and losses because the timing of realization of gains or losses can obscure trends in the underlying business. Berkshire posted net earnings for 2010 of $12.97 billion, a 61 percent increase over 2009 net income. Excluding investment and derivatives gains and losses, Berkshire’s earnings increased to $11.1 billion in 2010, a 47 percent increase over 2009.

A large portion of the increase in earnings can be attributed to Berkshire’s acquisition of Burlington Northern Santa Fe on February 12, 2010. BNSF posted $2,235 million in net income from the date of Berkshire’s acquisition of the railroad through year-end. Excluding the impact of BNSF, Berkshire’s earnings advance in 2010 would have been far more modest.

Berkshire’s insurance and utility businesses generally post results that are not correlated with overall economic activity and both groups posted solid results for 2010. Berkshire’s diverse manufacturing, service, and retail businesses recovered sharply from depressed levels in 2009 and surpassed net income posted in 2008.

Insurance Results

Berkshire Hathaway has now posted underwriting profits for eight consecutive years. Pre-tax underwriting income in 2010 was $2,013 million and total float grew to $65.8 billion representing a -3.1 percent cost of float. Berkshire’s overall combined ratio was 93.5 percent for 2010. The following exhibit provides key data for each of Berkshire’s insurance groups for 2010:

When viewed in the context of more than a decade of performance, Berkshire’s insurance operations are even more impressive given Warren Buffett’s observation that even well run insurers such as State Farm typically post aggregate underwriting losses over long periods of time. Insurers willing to accept ongoing underwriting losses and the consequent positive cost of float must count on investment income to fully offset the cost of float and provide adequate returns on equity employed in the business. At Berkshire, float has been better than cost free for nearly a decade despite a soft pricing environment that continues to plague the industry.

It is interesting to examine Berkshire’s cost of float over a multi-year period in order to spot trends that could influence our evaluation of the durability of underwriting profits in the future. The following exhibit provides our calculations of Berkshire’s average cost of float for the twelve year period ending in 2010 segmented into two six year periods:

The calculation takes a simple average of the cost of float for each of the years within the respective ranges. We can see that Berkshire’s results over the 1999 to 2004 period were weighed down by General Re’s troubles during this timeframe while all other insurance operations posted negative cost float, on average. Over the 2005 to 2010 period, all insurance operations including General Re posted underwriting profits, on average. We can see that the average cost of float for the entire period, despite General Re’s difficulties, has been negative which bodes well for Berkshire’s ability to generate cost free float going forward.

The calculation takes a simple average of the cost of float for each of the years within the respective ranges. We can see that Berkshire’s results over the 1999 to 2004 period were weighed down by General Re’s troubles during this timeframe while all other insurance operations posted negative cost float, on average. Over the 2005 to 2010 period, all insurance operations including General Re posted underwriting profits, on average. We can see that the average cost of float for the entire period, despite General Re’s difficulties, has been negative which bodes well for Berkshire’s ability to generate cost free float going forward.

We have much more to say on the valuation of Berkshire’s insurance subsidiaries in our full report on Berkshire.

Manufacturing, Service, and Retail

Berkshire’s diverse group of manufacturing, service, and retail businesses have fully recovered from the recession in terms of revenues and earnings. The group posted revenues of $66.6 billion and net income of $2,462 million for 2010 which exceeds comparable figures for 2008.

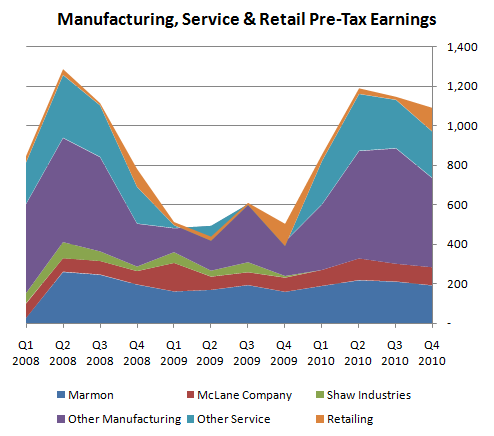

Over the past several quarters, we have presented an exhibit showing pre-tax earnings for each of the reporting segments within this group. The exhibit has been updated to include fourth quarter data and appears below (note that Shaw has been absorbed into the “Other Manufacturing” group as of Q1 2010):

While examining results on a quarter to quarter basis may not make much sense during normal economic times, the exhibit is revealing when considered in the context of the severe recession. We can clearly see the pummeling that most of Berkshire’s businesses suffered during late 2008 and all of 2009 before a steep recovery began in the first quarter of 2010. In particular, NetJets has staged a major recovery in 2010 after a year of severe losses.

For More Information …

In this article, we have only scratched the surface by looking briefly at Berkshire’s insurance and manufacturing, service, and retail groups. For more information on Berkshire’s 2010 results, a comprehensive review of each of Berkshire’s reporting segments, estimates of intrinsic value, and discussions regarding management succession, pre-order The Rational Walk’s forthcoming report In Search of the Buffett Premium. Those who pre-order will be the first to receive the report when it is released next week. We are incorporating data from Berkshire’s annual report as well as awaiting data from the 10-Ks expected to be filed on Monday for Berkshire, Wesco Financial, Burlington Northern Santa Fe, and MidAmerican Energy.

Disclosure: Long Berkshire Hathaway