There are few prices in America that are more visible than the cost of gasoline at the pump which has recently been on a rapid upward march reminiscent of mid-2008. At that time, price spikes brought the cost of gasoline to well over $4 per gallon in most of the country. The causes of oil price spikes vary over time but we can be sure that any hint of turmoil in the Middle East will have this effect. Although there is vigorous debate among economists regarding the specific price point at which oil will threaten the nascent economic recovery, there is no doubt that consumer confidence and spending would be adversely impacted if prices continue to rise at the current pace.

There are few prices in America that are more visible than the cost of gasoline at the pump which has recently been on a rapid upward march reminiscent of mid-2008. At that time, price spikes brought the cost of gasoline to well over $4 per gallon in most of the country. The causes of oil price spikes vary over time but we can be sure that any hint of turmoil in the Middle East will have this effect. Although there is vigorous debate among economists regarding the specific price point at which oil will threaten the nascent economic recovery, there is no doubt that consumer confidence and spending would be adversely impacted if prices continue to rise at the current pace.

Historical Context

Investors like to examine pricing anomalies, particularly related to commodities that could be viewed as substitutes but trade at radically different prices. One barrel of crude oil has approximately six times the energy content of one thousand cubic feet (mcf) of natural gas. One mcf of natural gas is approximately equivalent to one million BTUs (MBTU).

Despite the energy equivalence, for a variety of reasons, the pricing relationship between oil and natural gas is almost never exactly six to one. Typically, a ratio of 10 to 1 has been more common in recent years, although the ratio varies widely as we discussed in an October 2009 article describing the issue in more detail. More recently, we revisited the oil/gas pricing situation in December 2010.

Pricing Anomalies at Extreme Levels

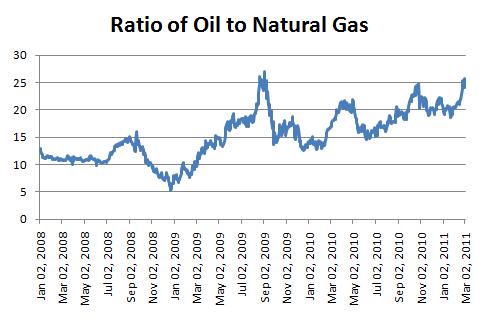

With the recent spike in oil prices due to political turmoil in North Africa and the Middle East, the ratio has approached extreme levels of approximately 25 as the chart below plotting the ratio of one barrel of WTI oil to 1 MBU of natural gas illustrates:

The following chart visually represents how extreme the current pricing situation is. We are using WTI crude prices in the exhibit as a good proxy for domestic crude prices but the ratio would be even more extreme if Brent crude were used:

From a pure energy equivalence perspective, it costs in excess of four times as much to purchase crude oil compared to natural gas. While oil has steadily increased in price over the past two years, the price of natural gas has continued to struggle to rally due to higher supply produced by shale plays in the United States. The oversupply of natural gas has caused some companies to switch their focus to shale oil plays, but this may not have more than a marginal impact in the short run.

Investing Implications

Natural gas appears to be cheap compared to oil and has been cheap for some time. Speculating in commodities is a risky endeavor since pricing anomalies can persist for very long periods of time. In addition, important fundamental factors related to supply help to explain at least part of the cheapness of natural gas relative to oil. Here is what Warren Buffett had to say about natural gas in a recent CNBC interview:

JOE KERNAN: You haven’t really bought natural gas or oil in the ground or–typically, right?

BUFFETT : Not very often, no. And, you know, it–I don’t know–the oil picture five years from now will be to, you know, may be much more dependent on politics than whether I can pick the best geologist in the United States. And, you know, I know we’ll be using more natural gas, I know it’s got all kinds of advantages and it’s cheap on a BTU equivalent to oil and it’s cleaner and all kinds of things. But in the end the price depends on supply and demand. And even though demand will go up some, I don’t know whether supply’s going to go up even faster than that. And so far it’s been–the last few years I should say that, you know, natural gas has been pretty disappointing. It hasn’t been disappointing in terms of finding it, hasn’t been disappointing in terms of its performance, it’s just been–there’s been too much of it around. And I don’t know–I’m not good at figuring out, you know, whether that will change a year from now, or five years from now, and I’m not in that game.

We have written about Contango Oil & Gas company in the past and believe it has a low cost advantage over other producers and could benefit from increasing natural gas prices over time. However, as Mr. Buffett says, the supply and demand dynamics could keep a lid on natural gas prices for many years even if demand increases but supply increases more quickly. In this type of environment, the low cost producer should benefit, particularly if Contango CEO Ken Peak is correct regarding the need for $6 natural gas for shale plays to earn a 5 to 10 percent return.

Public Policy Implications

At a time when the price of oil is dictated largely by developments outside the United States, it appears almost self evident that sources of domestic energy should be considered for economic and national security reasons. The argument for domestic energy is even stronger when one considers how much cheaper natural gas is compared to oil on an energy equivalent basis. An added bonus is the fact that natural gas is a cleaner burning fuel compared to both coal and crude oil.

T. Boone Pickens, among others, have advocated wider use of natural gas. Mr. Pickens believes that the 18-wheeler truck fleet could be converted to use natural gas rather than diesel:

About 70% of the oil we import is used as fuel for America’s 250 million cars and light trucks and 6.5 million heavy trucks. Nearly half of the oil used for transportation is used as diesel fuel to power 18-wheelers. Natural gas is the only alternative. It is not only more abundant; it costs half as much and emits almost 30% less carbon dioxide.

If, in the normal course of replacements, we exchanged those 6.5 million heavy trucks running on largely imported diesel for new ones running on domestic natural gas, we could reduce our imports by 2.5 million barrels per day. We would be able to reduce our dependence on oil from the Middle East by half in only seven years.

Public policy currently places a heavy emphasis on alternative energy sources including wind power and solar. In addition, the United States has counterproductive policies that heavily subsidize the use of ethanol as a motor fuel, a practice that Berkshire Hathaway Vice Chairman Charlie Munger has called “monstrously stupid” due to the impact on food prices. However, ethanol has a formidable lobby in Washington and enjoys bipartisan support.

Ultimately, if given the choice between spending $100 on a barrel of oil versus $23 on the equivalent energy provided by natural gas, a rational individual would favor natural gas purely based on the economics of the situation. When one adds in the fact that natural gas is a cleaner burning fuel and is available in abundance from domestic sources, it is surprising that broader political support does not exist for wider use.

Data Sources:

EIA: Cushing OK WTI Spot Prices

EIA: Natural Gas NYMEX Spot and Futures Prices

Disclosure: Long Contango Oil & Gas.