Markel CATCo is a leading insurance linked securities investment fund manager and reinsurance manager based in Bermuda. Markel completed the acquisition of CATCo Investment Management and CATCo Reinsurance Ltd. in December 2015 for total consideration of $205.7 million paid in cash. Retention payments and performance bonuses based on the results of the business through 2018 is estimated to cost an additional $100 million.

Markel CATCo is a leading insurance linked securities investment fund manager and reinsurance manager based in Bermuda. Markel completed the acquisition of CATCo Investment Management and CATCo Reinsurance Ltd. in December 2015 for total consideration of $205.7 million paid in cash. Retention payments and performance bonuses based on the results of the business through 2018 is estimated to cost an additional $100 million.

The Rational Walk has covered Markel in the past and we have followed the CATCo acquisition with interest over the past few months. Markel released results for the first quarter of 2016 on May 3 which included some additional details regarding the acquisition. In this article, we take a brief look at the insurance linked securities market as well as Markel’s increased involvement in this market due to the CATCo acquisition.

Insurance Linked Securities

The market for insurance linked securities (ILS) has grown rapidly over the past five years as capital market participants search for securities offering higher yields in the midst of a historically low interest rate environment. Catastrophe bonds represent the largest segment of the ILS market. Cat bonds are structured to pay interest and principal based on a catastrophe event that exceeds a certain magnitude or causes aggregate losses in excess of a specified amount.

Property/casualty insurers and reinsurers can utilize cat bonds to transfer risk from their books to capital market investors which reduces overall risk and frees up capital that would otherwise remain tied up. For a more detailed write-up on the basic characteristics of the ILS market, readers may refer to Insurance-Linked Securities: Catastrophe Bonds, Sidecars, and Life Insurance Securitization published by the National Association of Insurance Commissioners. Artemis, a website focusing on ILS, provides a listing of the latest catastrophe bonds and ILS offerings which illustrates the wide variety of insured risks and bond terms.

The size of the cat bond and ILS market has grown significantly in recent years although issuance declined in the aftermath of the financial crisis. The following exhibit from the Artemis website shows that the overall market size has been approximately $25 billion over the past few years:

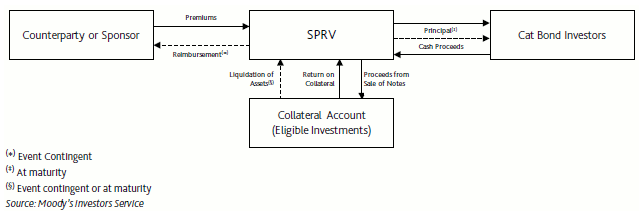

Artemis has published a useful article describing the overall structure and mechanics of cat bonds. Typically, an insurer or special purpose vehicle is set up, enters into a reinsurance transaction with a counter-party, and receives a premium in exchange for providing the coverage. Securities are issued to investors and the principal is invested into a collateral account. Investor coupon payments are comprised of interest payments from the collateral account and the premium. Assuming that the triggering event does not occur, investors receive principal at the end of the term from funds in the collateral account. The exhibit below, sourced from Moody’s and included in the Artemis article, is a good illustration of the mechanics of a catastrophe bond:

In addition to providing attractive yields in a low interest rate environment, cat bonds are not typically correlated with other financial markets. In other words, a triggering event that results in the loss of part of all of the principal of a cat bond is unlikely to also result in commensurate losses in other financial instruments. There could be certain exceptions such as the chain reaction of events associated with the 2011 Fukushima Daiichi nuclear disaster in Japan. The disaster was caused by a tsunami triggered by an earthquake and was severe enough to cause serious regional economic damage and a stock market slump. However, an event such as a major hurricane in the United States is unlikely to be highly correlated with the overall stock market given the magnitude of such an event in the context of the overall economy.

Cat bonds, and ILS generally, represent additional capital flowing into the reinsurance market and could be expected to contribute to overall soft pricing for risks. Berkshire Hathaway Chairman and CEO Warren Buffett and other industry participants have recently commented on how pricing in reinsurance is inadequate to ensure acceptable underwriting profitability in the long run. One could view the growth of ILS to be a contributing factor and a warning sign. However, a recent article argues that the ILS market has taken Mr. Buffett’s warnings into consideration, especially with respect to pricing. As an outside observer, it is difficult to know whether this is the case and we may need to go through a full reinsurance pricing cycle before evaluating the results.

Markel’s Increases ILS Involvement via CATCo

Markel’s acquisition of CATCo included CATCo Reinsurance Ltd. and CATCo Investment Management. Markel CATCo Reinsurance is a Bermuda licensed reinsurance company that provides clients with custom programs to meet their reinsurance needs. Markel CATCo Investment Management offers funds to investors that provide diversified portfolios made up of risks accessed through the reinsurance operation. As of March 31, 2016, the investment management business had total assets under management of $3.2 billion.

Markel is participating in the ILS market as both a fund manager through Markel CATCo Investment Management as well as through an investment in one of the funds offered by the manager. The investment management operation began receiving management fees for investment and insurance management services on January 1, 2016. In addition, performance fees may be earned based on annual performance of the investment funds under management. According to management’s comments in the first quarter conference call held on May 4, the revenue associated with management fees is expected to vary from quarter to quarter with a higher figure expected in the fourth quarter assuming performance targets are attained. The investment management business posted a $2.8 million loss in the first quarter which was attributed to acquisition and integration costs as well as the impact of bonuses that are not expected to be recurring.

Markel has also made investments in funds offered by Markel CATCo Investment Management and, as a result, will participate in the performance of the funds along with other investors. In October 2015, Markel made a $25 million investment in one of the CATCo funds prior to closing of the acquisition. This investment, along with an additional $175 million investment made in January 2016, are now invested in the Markel CATCo Diversified Fund.

The investment is far from risk free, as President Michael Crowley’s comments in the conference call illustrate:

In terms of the $200 million investment we’ve made in CATCo, the potential is – there need to be multiple events, but the potential is we could lose the entire $200 million. And that is the same for virtually any other investor in CATCo. There is a slight complication to that. We have multiple funds. And in some of the funds we actually do go out and hedge some of the risks for the investors in those funds, so their results could be slightly different as a result of that.

But in a multi-event – large event scenario, Markel could lose the entire investment. That is highly unlikely. In a one event, sort of large event loss we can lose as much as approximately $50 million of the $200 million. CATCo’s product is – not to get into great detail, but CATCo’s product is little different than most other cat products out there as opposed to a single shot retro sort of product. It is a multi-pillar product and you can have up to four losses against the product and the entire limit does not erode unless you have up to those four losses.

The majority of Markel’s investment in the CATCo funds are classified as Level 3 equity investments indicating that the net asset value of the fund is calculated using both observable and unobservable inputs. Markel may redeem the investment on January 1st of each calendar year.

Conclusion

As an outside observer, it is difficult to evaluate Markel’s acquisition of CATCo in terms of its long term potential. Markel has the ability to profit from management fees generated by the $3.2 billion of assets under management and also is a participant in the funds through its $200 million investment.

Catastrophe bonds and insurance linked securities serve an important role by bringing capital provided by market participants into the insurance and reinsurance industries. However, at least at a superficial level, it is difficult to not view this additional inflow of capital with some degree of suspicion given the soft pricing conditions in reinsurance that Warren Buffett and others have been warning about for several years.

Market participants who purchase ILS and mutual funds comprised of ILS are looking for yield in an environment where yield is exceedingly difficult to come by. At least some percentage of these investors are probably lulled into a false sense of security due to the lack of recent mega-catastrophes. When (not if) a major mega-catastrophe occurs, we can expect plenty of cat bonds to be wiped out. At that time, the overall market could very well shrink reducing the assets under management of firms such as Markel CATCo.

Markel’s management is obviously well aware of the soft pricing environment in reinsurance and elected to go forward with the acquisition in spite of these conditions. In addition, the $200 million investment in the Markel CATCo Diversified Fund is a vote of confidence in the market. Ultimately, we will have to wait for a full reinsurance cycle to occur before we will know the results of the ILS market in general and the impact on Markel CATCo.

Disclosure: Individuals associated with The Rational Walk LLC own shares of Markel Corporation.