In Today’s Issue:

- Tesla Short Squeeze?

- The Panic of 1901

- Staying Informed Amid the Noise

- Taming Your Cell Phone

To read last week’s newsletter about my Apple mistake, Jim Lehrer’s style of journalism, coronavirus, Taleb’s precautionary principle, and proposed changed to goodwill accounting, please click here.

Tesla Short Squeeze?

The world probably does not need more commentary regarding Tesla’s recent parabolic rise, but the topic is irresistible to anyone who follows financial markets.

As I type these words on February 4 at around 11:30 EST, Tesla is trading around $890, up over 14 percent for the day. This follows a 19.9 percent gain on February 3 which follows a 15.2 percent gain last week. At $890, the stock is up 113 percent so far in 2020. By the time you read this email, Tesla should easily be over $1,000 if current trends hold, or it could be back at $500 if the tide turns.

Check out the Tesla chart over the past year:

As Charlie Bilello pointed out on Twitter, at $161 billion, Tesla, as of Tuesday morning, had a higher market capitalization than General Motors, Ford, Fiat Chrysler, and Daimler combined. No matter how optimistic one may be about Elon Musk’s ability to dominate the auto industry (or enter new industries) in the years and decades to come, the stock’s recent rise seems to have its roots in something other than market fundamentals.

It is anything but “normal” for a company as large as Tesla to exhibit price movements more common for early stage biotech stocks. Certainly, the fundamentals of the business cannot possibly be changing this rapidly. Apparently, the concerns over coronavirus that have recently impacted the stocks of other large companies with China operations, such as Apple, have not concerned Tesla investors. Tesla recently opened its gigafactory in Shanghai after it was built in a very short period of time.

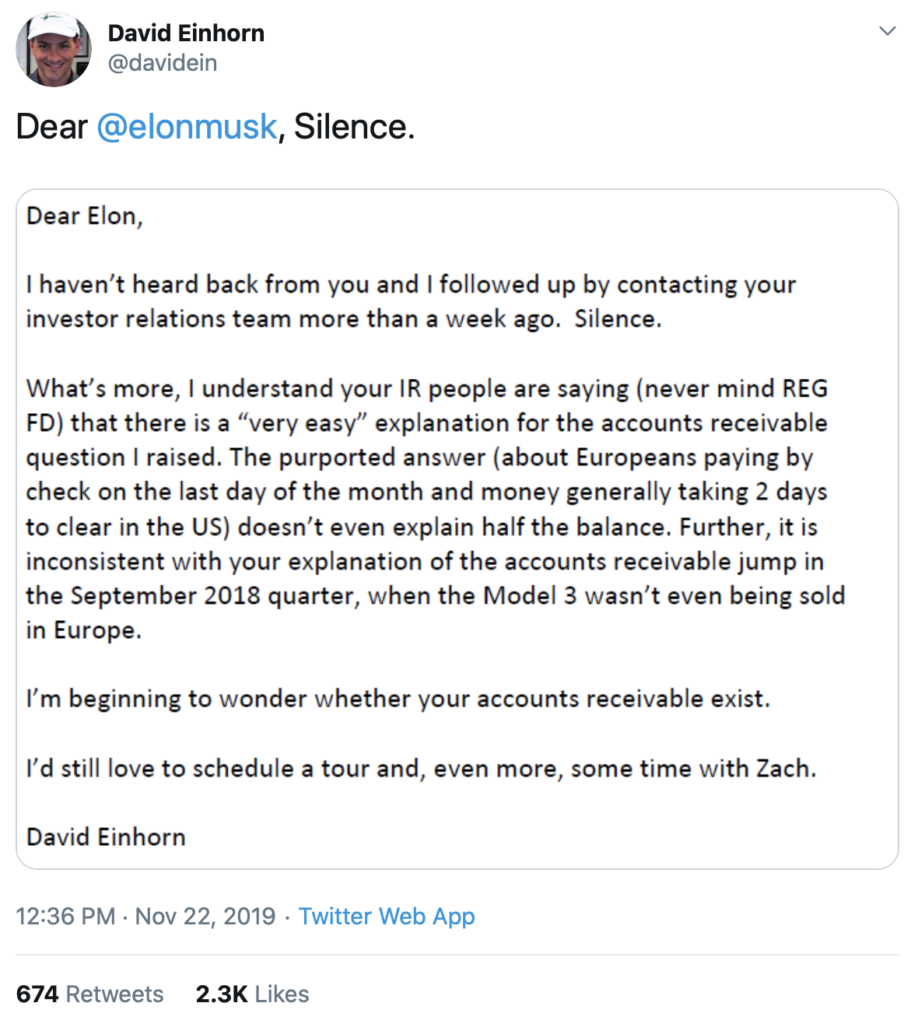

Tesla has long perplexed short sellers who aim to profit by borrowing shares of the company and selling them, hoping to be able to replace the borrowed shares at a later date at a lower price. One of the most prominent short sellers of Tesla stock is David Einhorn who has been known to spar with Elon Musk on Twitter, most recently in November:

Tesla closed on November 22, 2019 at $333.

Short selling is incredibly difficult.

As Charlie Munger has said regarding short selling, “We don’t like trading agony for money”. Whether the current action in Tesla stock is a result of a short squeeze or some other factor is not at all clear. I have never seriously considered Tesla as an investment, although I did look at the company briefly after reading a biography of Elon Musk in 2016. For a recent look at Tesla’s valuation, I recommend Professor Aswath Damodaran’s January 30 article.

As I recheck Tesla’s quote at 12:50 pm on February 4, Tesla is up to $912, or 2.5 percent above its level when I started writing. At this rate, the price should easily exceed $1,000 by the time you read this!

The Panic of 1901

I have started to do my “serious” reading first thing in the morning, a time that seems more conducive to absorbing information. Today, I traveled back to the late nineteenth century as I resumed my reading of The House of Morgan by Ron Chernow. Other than reading Titan, an epic biography of John D. Rockefeller, also written by the same author, the “robber baron era” of the late nineteenth and early twentieth century is not a period of history that I have spent much time reading about.

When it comes to financial markets, one thing that doesn’t seem to change is the periodic occurrence of financial manias and panics. Early in the book, Chernow tells the story of the panic of 1901 which had its roots in a dispute over the Chicago, Burlington, and Quincy (CB&Q) railroad. With financing provided by J. Pierpont Morgan, James J. Hill had created a rail system dominating transportation in the Northwest by combining the Great Northern and Northern Pacific railroads. Hill decided to buy the CB&Q which would give his network a direct connection to Chicago and a potential link to the New York Central which had significant ties to Morgan.

The prospect of a transcontinental system alarmed Edward Harriman who had combined the Union Pacific and Southern Pacific railroads in 1895. Harriman tried to negotiate with Hill and Morgan to take a stake in the CB&Q but he was rebuffed. In response, Harriman and his bankers decided to try to take control of the Northern Pacific which set in motion a series of events leading to a bubble and subsequent panic.

Harriman’s group began buying up shares of Northern Pacific in April 1901, spending $78 million to buy up stock in what was the largest market operation up to that time. This was done secretly and Morgan interpreted the rise as a bullish response to the launch of U.S. Steel. Northern Pacific stock rose so quickly that even the company’s board members sold.

By early May, Harriman was only 40,000 shares short of majority control of Northern Pacific but, before he could purchase a controlling interest, Morgan apparently realized what was happening and authorized his bank to buy 150,000 shares “at any price”.

On Tuesday, May 7, 1901, the stock closed above $143, a gain of $70 in just three days. On May 8, the stock crossed the $200 level. As this parabolic rise took hold, short sellers started to panic. They began to liquidate stock in other companies in order to buy back the shares of Northern Pacific that they previously shorted before the price rose even more!

On May 8, the stock prices of almost all other stocks on the exchange were crashing as short sellers liquidated their positions to raise cash needed to cover their Northern Pacific short sales. On Thursday, May 9, Northern Pacific’s price skyrocketed above $1,000 before subsequently dropping $400 on a single trade.

Hill and Morgan retained control of Northern Pacific when the dust settled but the cost of doing so was a major stock market panic. Morgan eventually stopped the panic by announcing that short sellers would be allowed to buy shares in Northern Pacific at $150 per share. If he had not done so, Chernow says that more than half of the brokerage houses on Wall Street might have failed.

1901 was a different era in history but market psychology was not that different from today. Efficient market theorists might think that market prices are set in the short run by dispassionate analysis and results from an Excel spreadsheet but, in reality, greed and fear drive markets in the short run and probably always will.

Staying Informed Amid the Noise

In the 21st century, news delivery resembles an open firehose that is never turned off. The flow is constant, noisy, ever present, and much of it is of questionable veracity. For these reasons, consumption of news can be overwhelming. There is no “end” to reading the news anymore, as there used to be when you finished the newspaper or the evening news broadcast ended.

If you are an investor, almost nothing that is happening right now has a material impact on the companies you own. As a citizen, almost nothing that is happening right now has much relevance either. Other than emergency situations, simply opting out of the daily news flow can be a viable strategy. However, many of us find the allure of the news too strong to resist and, if that is the case, we need to find a system that will allow us to benefit from what is out there while not being consumed by it.

Like almost everyone, I have struggled with this constant flow of information and I’ve come up with a personal system that seems to work well. The basic idea is to not read news as I encounter it but to instead browse content based on what looks interesting and add articles to a list. When I get to the point where I want to read articles, I curate the list of articles based on the amount of time available and then I actually read them.

This “browse, curate, and consume” cycle seems to work for me and is outlined in more detail in an article posted earlier this week.

Taming Your Cell Phone

Ryan Holiday published an interesting article this week on how to spend less time on your phone. His “radical guide” is not actually that radical, in my opinion, and mostly boils down to letting your phone serve you rather than the opposite. His key message is to avoid hard interrupts that destroy the state of flow required to accomplish anything meaningful.

Of his suggestions, turning off almost all alerts is the quickest way to take back control. Charging your phone away from your bedroom and starting each morning phone free are also excellent suggestions that I adopted last year. More interestingly, he’s an advocate of using more technology to escape the shackles of his phone. By using a smart watch and AirPods, Holiday avoids looking at his phone as often while still retaining the functionality he wants to access. I am skeptical of the idea of using more technology in this manner but maybe it would work for some people.

Modern smartphones trigger the same dopamine pathways that often result in substance abuse and other compulsive behavior. One of the major challenges of the 21st century will involve how we can benefit from technology and the wealth of information it unlocks while avoiding the negative side effects.

That’s all for this week. The next issue of Rational Reflections will be sent out on Wednesday, February 12. Any feedback is welcome and can be sent to administrator@rationalwalk.com. Thanks for subscribing!

Was this email forwarded to you by a friend or colleague? Sign up here to receive Rational Reflections directly every week.