Daily Journal Corporation is a publisher of several small specialty newspapers and information services primarily serving the legal and real estate communities in California and Arizona. With the company’s traditional business experiencing a steady secular decline in recent years, management leveraged its expertise and connections in the legal community to diversify into software management systems for courts and other justice agencies. A temporary boom in foreclosure notices driven by the housing crash generated cash flow that was used to build a concentrated portfolio of investments under the direction of Chairman Charles Munger. This portfolio has appreciated significantly in recent years and has left Daily Journal materially overcapitalized.

We first discussed Daily Journal five years ago when software was a relatively minor part of the company and there was only limited disclosure of the securities in the investment portfolio. At the time, we speculated that the company could be turning into a “hedge fund” that would allow investors to participate in the investment decisions made by Mr. Munger:

The Daily Journal Corporation represents a fascinating case study of a declining business that is still generating significant free cash flow that has been intelligently deployed by management to create additional value for shareholders. Such a company is in a distinct minority since most firms facing decline tend to pursue value destroying acquisitions or capital investments rather than “accept defeat” gracefully and return cash to shareholders. It seems likely that Daily Journal’s publishing operations will continue to decline over time and Sustain [a software business] is an unpleasant wildcard threatening to destroy additional value. However, with Mr. Munger at the helm, the marketable securities portfolio seems likely to at least preserve value for shareholders. Once Mr. Munger and Mr. Guerin are no longer involved with the company, it would seem only logical to distribute funds to shareholders since there will not be any in-house capability for managing a large investment operation.

To answer the question posed by the title of this article, Daily Journal is not a “rising hedge fund” given management’s intentions to not develop an investment business. However, it is at least a quasi investment fund operated by Mr. Munger that does not carry a typical “2 and 20” fee structure. This may intrigue venturesome investors who are also optimistic (or at least not terribly pessimistic) about the durability of the operating business.

Daily Journal shares traded at approximately $65 in late 2011 and currently trade at $242 which represents a compounded annual return of 30 percent. Obviously, anyone who decided to buy shares five years ago has been richly rewarded. The good news is that the investment portfolio has appreciated significantly over the past five years. The bad news is that the newspaper publishing business has continued to decline and the company’s software business, which was dramatically increased due to acquisitions, has failed to achieve profitability. The other bad news is that all the principal players are five years older. President, CEO, CFO, Treasurer and Director Gerald Salzman is now 77, Vice Chairman J.P. Guerin is 86, and Mr. Munger will turn 93 on January 1. No succession plans have been disclosed.

In this article, we focus on the developments that have taken place over the past five years in the company’s three operating segments: (1) The traditional publishing business; (2) The Journal Technologies software business; and (3) Corporate, which includes the investment portfolio. Readers interested in background on the company prior to 2011 should first read our prior article referenced above.

Traditional Publishing Business

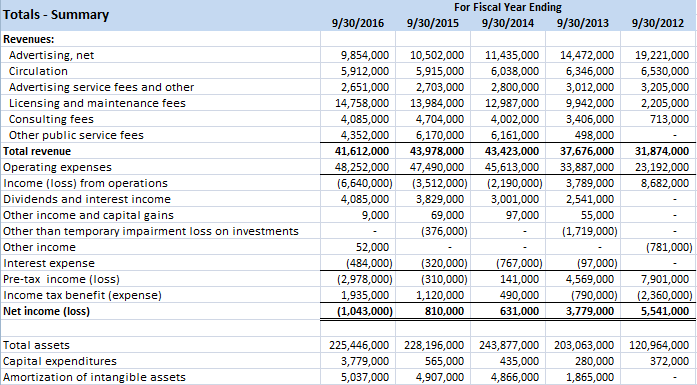

The traditional newspaper business has been in steady decline over the past five years with advertising revenue taking the biggest hit. Public notice advertising for foreclosures resulted in elevated revenue for a number of years but the housing recovery in California and Arizona has dramatically reduced this business over the past few years. A steady reduction in circulation of the San Francisco and Los Angeles Daily Journals, which represent the company’s most important publications, has resulted in a decline in circulation revenue as well as further advertising declines. Revenue and net income have declined in each of the past five years, as shown in the exhibit below:

As revenues have declined, the company has apparently suffered from diseconomies of scale which resulted in margin pressure. The company’s SEC filings indicate that revenue reductions will continue to have a significant impact on earnings “because it will be impractical for the Company to offset the expected revenue loss with expense reductions.” Margins have declined accordingly.

Over the past several years, the company has discontinued the publication of several smaller titles with very low circulation. Although the company still offers nine publications, the San Francisco and Los Angeles Daily Journals represent the vast majority of circulation revenue. The exhibit below shows that management has been able to raise the subscription price which has partially offset the steep decline in paid circulation (click on the exhibit for a larger view):

It is difficult to see what might cause circulation trends to reverse or even stabilize. There appears to be a core constituency that is not price sensitive (the annual cost of a full price subscription is $804); however, every year there is a steady erosion in circulation. Not only will circulation revenue continue to decline, but the publications will be less attractive to advertisers as well. In order to continue to provide a quality product, management cannot cut expenses proportionally since many costs are fixed in nature. We continue to view this business to be one in secular decline that could end up being terminal at some point over the next decade.

Journal Technologies

Five years ago, the company’s software operations were limited to the Sustain subsidiary which was acquired in 1999. As we discussed in our prior article, Sustain had not provided consistent profitability up to that point in time. However, the software business was a minor part of Daily Journal’s overall operations. This has changed significantly with the acquisition of New Dawn in December 2012 and ISD in September 2013. The Journal Technologies business accounted for 56 percent of revenue in fiscal 2016, up from only 9 percent in fiscal 2011.

Management was able to fund the purchase of New Dawn and ISD by borrowing $29.5 million against the securities portfolio using a margin account. This has proven to be low cost financing with the interest rate fluctuating based on the Federal Funds Rate plus 50 basis points. This funding has become more expensive after the Fed’s recent rate increase and could become more expensive if forecasts for additional rate increases in 2017 prove to be correct.

At least so far, the software business has not proven to be profitable for the company. The exhibit below shows the result for the Journal Technologies group over the past five years:

It should be noted that amortization of intangible assets, a non-cash charge, is a major component of operating expenses for the segment. The intangibles consist primarily of customer relationships acquired as part of the New Dawn and ISD acquisitions and are being amortized over five years. The amortization charge is expected to be $4.9 million in fiscal 2017 and $3.1 million in fiscal 2018 and there will not be any further charges beyond that time. Assuming that the acquisitions were well thought out, it is unlikely that the customer relationships acquired will be worth nothing in 2018. If that is the case, at least part of the amortization charge over the past four years can be regarded as meaningless from an economic standpoint. However, even if we regard all of the amortization expenses as economically meaningless, this segment would still not be profitable.

Corporate (Including Investment Portfolio)

The corporate segment primarily represents the results of the company’s investment portfolio. As of September 30, 2016, the company held securities with a market value of $166.6 million with an unrealized gain of $108.3 million. The portfolio was concentrated in seven companies with two based in foreign countries, with the foreign issues valued at $45.5 million* in aggregate.

Four of the securities are included in the company’s 13-F report which is filed with the SEC on a quarterly basis. As of September 30, 2016, the 13-F portfolio consisted of Wells Fargo, Bank of America, U.S. Bancorp, and POSCO ADRs. Mr. Munger has left the portfolio almost completely static over the past several years, at least with respect to the positions that are required to be disclosed to the SEC. For those who have followed Mr. Munger for many years, this lack of activity and extreme concentration is not the least bit surprising.

The exhibit below shows the results of the Corporate segment since 2013 when the company first began breaking it out as a reporting segment.

What is notable is the steady increase in dividend income attributable to the portfolio and the fact that the corporate segment now accounts for the majority of the company’s overall profitability. It is apparent that the company is massively overcapitalized. Although management has noted that there are some benefits to the software business of appearing to be a “large” firm, we can conclude that the vast majority of the investment portfolio, net of the margin loan, could be distributed to shareholders if management chose to do so.

Consolidated Summary

When we look at each of the company’s segments in isolation, we observe a traditional business that is in steady decline but still marginally profitable, a software business that has yet to provide profits, and a corporate segment dominated by an investment portfolio that has performed extremely well since it was opportunistically acquired several years ago.

The consolidated results of the three segments, reconciled to the income statement, are displayed in the following exhibit:

Although the company posted a loss in fiscal 2016, this was due to amortization of intangible assets that are probably not entirely economic costs. Aside from this amortization charge, the company is still modestly profitable. Operating cash flow was $1.2 million in fiscal 2016.

Conclusion

It is difficult to evaluate Daily Journal’s future prospects given that both operating businesses appear to be struggling. We can probably conclude that the traditional publishing business is a wasting asset that will eventually either shut down or, more likely, transform into an information service accessible only on the internet. The information the publishing segment provides is necessary and will continue to be necessary for members of the legal profession. The question involves the economics of providing this information in the long run and it is difficult for an outsider to gain much confidence in how events will transpire.

The software business has failed to generate profits so far and revenue was stagnant from fiscal 2014 to fiscal 2016. Management clearly has established relationships in the legal field and the investment portfolio provides customers with confidence that a strong institution is backing their software investment. The software business could also eventually be spun off into a separate entity or acquired by a larger company. Still, it is difficult to estimate the value of the software business with much confidence.

The investment portfolio can clearly be valued given the availability of quotations for the securities. As of September 30, 2016, the portfolio was worth $166.6 million against a margin loan of $29.5 million and a deferred tax liability of $42.3 million. It is possible that some or all of the securities could be distributed directly to shareholders in the future since the vast majority are not required to run the business.

Daily Journal’s market capitalization is currently $328 million and shareholders’ equity was $125.3 million as of September 30, 2016. It seems very difficult to justify the large premium over book value given that the securities are worth only their contribution to book value and the operating businesses have very uncertain prospects. Still, given Mr. Munger’s involvement, Daily Journal is an interesting situation that should be monitored in the future.

* Correction: The original article posted on December 23, 2016 listed the value of foreign securities as $21.4 million. This figure is incorrect. The correct figure is $45,481,000, comprised of a foreign marketable security held in South Korean Won worth $12,667,000 and a foreign marketable security held in Hong Kong Dollars worth $32,814,000 as of September 30, 2016. Thanks to @GarethEast for pointing out the error.

Disclosure: No position in Daily Journal Corporation