“Most people overestimate what they can do in one year and underestimate what they can do in ten years.”

— Bill Gates

Every person will have a different definition of what counts as “the long run”, but it is probably fair to say that a decade is thought of as a long time by almost everyone. That is enough time to bring about major changes in life, whether positive or negative. And twenty years seems like half a lifetime ago for anyone under fifty. The daily and weekly vicissitudes of life come and go, good luck and bad luck influences months and years, but over a sufficiently long period of time, most of us reap what we sow. This seems broadly applicable in life but especially true in the world of investing. Over two decades, your results in business are not likely to deviate too far from what your results deserve to be.

When it comes to selecting securities for investment, few people think of the decision as equivalent to entering into a business partnership, as one might when purchasing an apartment building, farm, or gas station with partners. The reason is that securities seem abstract and remote. Investors no longer even receive physical share certificates. Securities might seem like nothing more than numbers on a brokerage statement or flashing across a computer screen. Prices also change on a daily basis adding to the casino-like nature of the experience. The constant onslaught of prices makes people regard securities as transitory experiences. You would never wake up one morning, read about the Federal Reserve’s latest interest rate decision, the latest status of China trade talks, or the progression of the coronavirus epidemic and suddenly decide to sell an apartment building that you own that afternoon. But you might very well log into your brokerage account and sell some stocks.

Of course, share ownership represents equity in a real business, albeit one that the investor is usually not personally involved with or in a position to influence. The fact that a business is publicly traded merely makes it easier to take an ownership interest. It does not change the underlying nature of what you are doing: You are buying a business.

Exactly twenty years ago, I made a decision to purchase my first shares of Berkshire Hathaway. I still hold those shares today along with many subsequent purchases over the years. Since 2009, I have written about the company frequently on this website. But the story of how my first purchase came about started several years before my decision in February 2000.

In the summer of 1995, I was a new college graduate with a degree in finance and, like many young people attracted to investing, I had excessive self-confidence brought about by thinking that mastery of academic finance would automatically translate into investing success. When I read Roger Lowenstein’s new biography of Warren Buffett, The Making of an American Capitalist, I was instantly captivated by the story of how Buffett built his empire. Buffett only appeared one time in my senior year finance textbook yet it seemed obvious that his philosophy deserved far more attention. I quickly read through Buffett’s letters to shareholders and remember thinking that they provided more value than my college degree.

Of course, I looked up Berkshire stock but at around $25,000 per share, one share of stock exceeded my accumulated net worth at the time which was saved up from childhood paper routes and part time jobs in high school and college. Berkshire was not investable for me at that time. Roughly a year later, Berkshire issued Class B shares in response to promoters of “unit trusts” that sought to own Berkshire shares and sell small fractions to individuals, for a hefty fee, of course.

When Buffett announced the recapitalization plans for Berkshire in the 1995 annual letter, released in early 1996, he stated that he and Charlie Munger did not believe that Berkshire, trading at around $36,000 at the time, was undervalued. I took him at his word at the time and did not buy any shares.

Over the next several years, I continued to watch Berkshire shares which more than doubled by mid-1998 before the company went out of favor toward the tail end of the dot-com technology mania that characterized the period around the turn of the century. Warren Buffett was getting close to seventy and repeatedly stated that he did not understand technology and was sitting out the tech stock craze. Berkshire also was having trouble with General Re, a recent acquisition, which was posting losses. Investors were abandoning the stock which, by early 2000, was back at levels not seen since 1997.

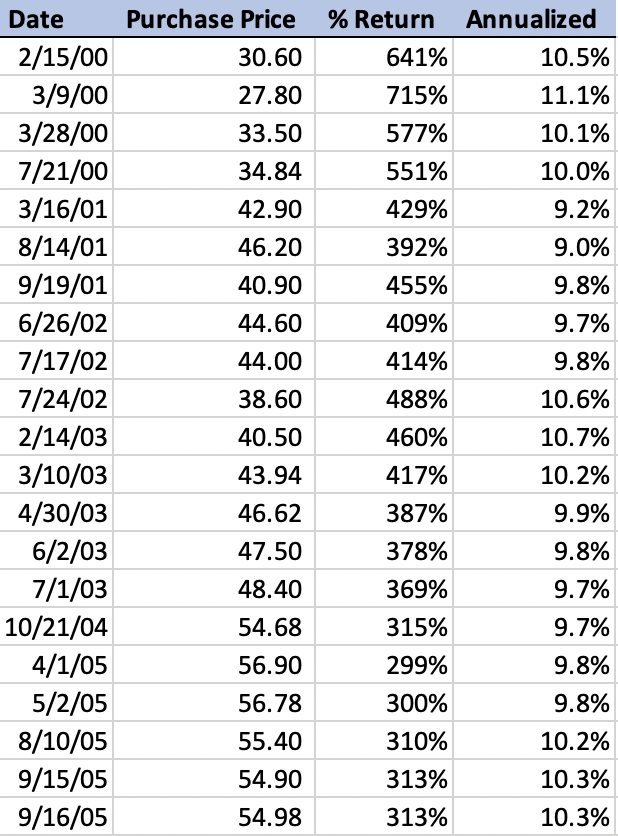

My initial purchases proved to be well-timed and this was no doubt due to luck. My initial class B shares were purchased on February 15, 2000 at $1,530 ($30.60 split-adjusted) and then I somehow came close to nailing the bottom on March 9, 2000 at $1,390 ($27.80 split-adjusted). The stock quickly ascended as the dot com boom imploded and Buffett signaled that Berkshire might be cheap enough to consider repurchasing shares. Value stocks began a multi-year ascendency.

The overall story of Berkshire is well known and has been discussed on this website many times, so I will not provide a recap of what has happened over the past two decades other than to say that Buffett defied all skeptics and somehow continued to run the company into his late 80s, found ways to compound intrinsic value through internal reinvestment, acquisitions, and securities purchases, and was able to avoid distributing any capital to shareholders. This internal compounding machine has chugged along for two decades despite widespread belief that Buffett would have to return capital or would soon retire.

My personal story is that I continued buying Berkshire shares over the next several years as I saved a large part of my income. Although I have purchased (and sold) shares of Berkshire over the past decade, I still hold all of the shares I purchased from 2000 to 2005. The purchases were made at various times, some well-timed while others less so, but in aggregate all have performed strongly. In aggregate, each dollar that I invested in Berkshire over the timespan from early 2000 to late 2005 has become nearly five dollars today, all while deferring all taxes until the shares are eventually sold.

The table below shows the dates of my purchases between 2000 and 2005, all of which I still hold today, along with the split-adjusted purchase price, the total return, and annualized return. What’s particularly interesting is that the annualized rates of return are all fairly close together despite some very different initial valuations at the time of my purchase. The price-to-book value, based on last reported book value, ranged from 1.1x book for my March 9, 2000 purchase to a very high 1.8x book for my August 14, 2001 purchase. In the very long run, returns are correlated to business performance rather than the transitory advantage or disadvantage arising from valuation at the time of purchase.

Warren Buffett and Charlie Munger purposely created, over a period of many decades, a culture in which shareholders are regarded as business partners rather than merely faceless providers of capital. This attitude has attracted long-term shareholders, some of whom have owned Berkshire for far longer than two decades. In the very long run, associating with talented individuals of high integrity and good business sense will generate satisfactory results.

As Charlie Munger likes to say, Berkshire shareholders sometimes resemble “cult members”, but if you are going to be a member of a cult, you could easily choose a worse one to belong to. The fact is that Berkshire has attracted a shareholder base with an unusually long-term oriented mindset and this culture is likely to outlast Buffett and Munger’s involvement in the business. It has definitely been both a profitable partnership and an excellent education.

Disclosure: Individuals associated with The Rational Walk LLC own shares of Berkshire Hathaway.